Budgeting is a fundamental aspect of personal finance management that serves as a roadmap for individuals seeking to achieve their financial goals. At its core, budgeting involves tracking income and expenses to ensure that spending aligns with financial objectives. The importance of budgeting cannot be overstated; it provides clarity on where money is going, helps identify unnecessary expenditures, and fosters a sense of control over one’s financial situation.

By establishing a budget, individuals can prioritize their spending, save for future needs, and avoid the pitfalls of debt accumulation. Moreover, budgeting is not merely about restricting spending; it is about making informed decisions that align with one’s values and aspirations. For instance, someone who values travel may allocate a portion of their budget specifically for vacations, while another individual might prioritize saving for a home.

This personalized approach to budgeting allows individuals to create a financial plan that reflects their unique circumstances and goals. Additionally, budgeting can reduce financial stress by providing a clear picture of one’s financial health, enabling proactive measures to be taken before issues arise.

Key Takeaways

- Budgeting is important for managing finances and achieving financial goals

- Look for features like expense tracking, goal setting, and customizable categories in a budget planner

- Beginner budget planner picks include simple apps like Mint or YNAB

- Advanced options like Quicken or Personal Capital offer more complex financial tracking and analysis

- Budget planner apps offer convenience while physical planners provide a tangible, visual aid

- Stick to your budget by regularly tracking expenses and adjusting as needed

- Customize your budget planner by setting specific financial goals and creating personalized categories

- Maximize your budget planner’s effectiveness by regularly reviewing and adjusting your budget, and staying disciplined in your spending habits

Features to Look for in a Budget Planner

When selecting a budget planner, several key features can enhance the budgeting experience and improve financial management. One of the most critical aspects is user-friendliness. A planner should be intuitive and easy to navigate, allowing users to quickly input their income and expenses without feeling overwhelmed.

Whether it’s a physical planner or a digital app, the design should facilitate straightforward tracking and analysis of financial data. Another essential feature is the ability to categorize expenses. A good budget planner should allow users to break down their spending into various categories such as housing, transportation, groceries, entertainment, and savings.

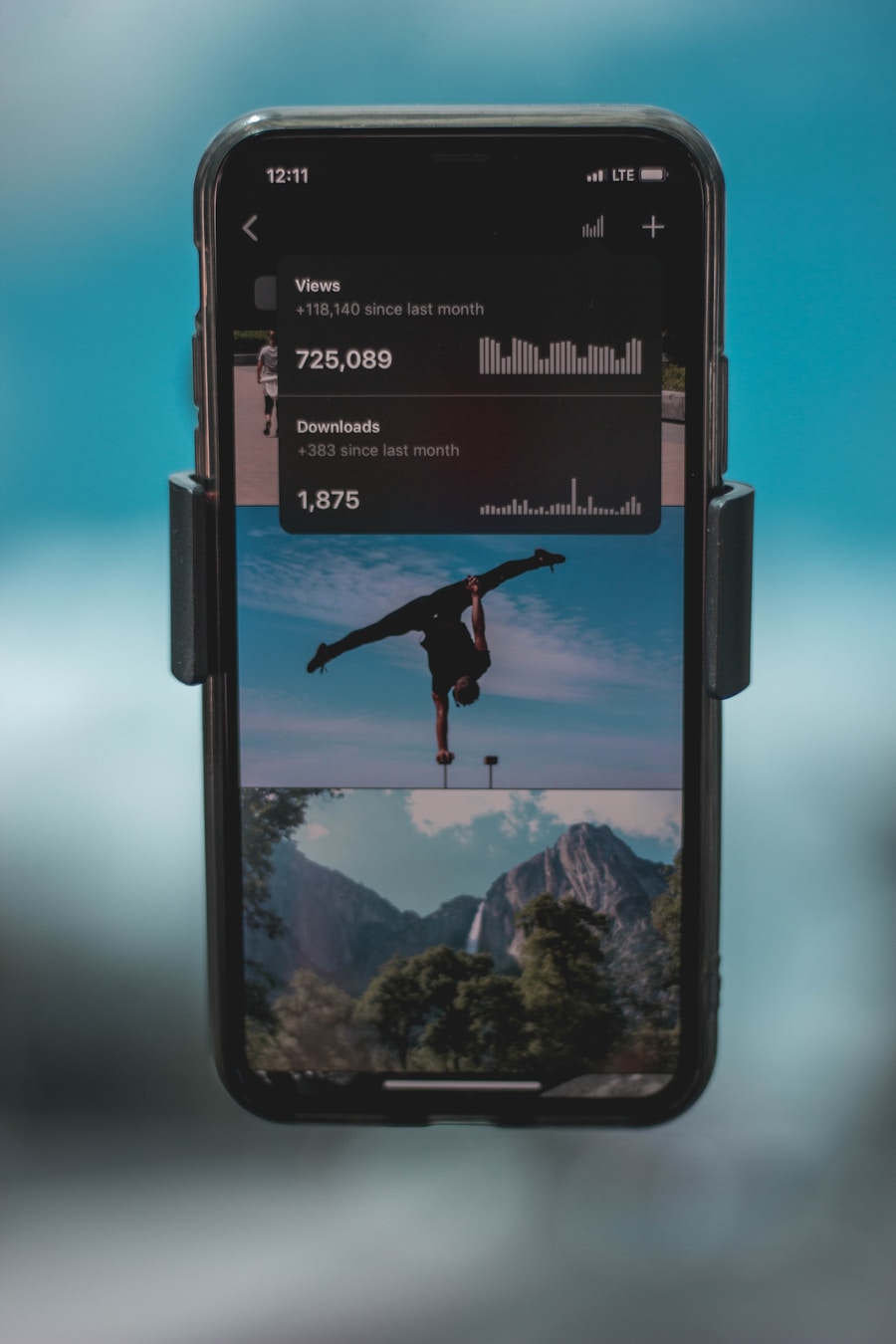

This categorization not only helps in understanding spending habits but also aids in identifying areas where adjustments can be made. Additionally, many planners offer visual aids like charts and graphs that provide a snapshot of financial health at a glance, making it easier to assess progress toward financial goals.

Top Budget Planner Picks for Beginners

For those just starting their budgeting journey, several budget planners stand out for their simplicity and effectiveness. One popular choice is the “EveryDollar” app, which offers a straightforward interface that allows users to create a zero-based budget easily. This method ensures that every dollar earned is allocated to specific expenses or savings goals, promoting accountability and discipline in spending.

Another excellent option for beginners is the “GoodBudget” app, which utilizes the envelope budgeting system. Users can allocate funds into virtual envelopes for different spending categories, helping them visualize their budget and avoid overspending. The app also features syncing capabilities, allowing multiple users to access the same budget, making it ideal for families or couples managing finances together.

Both of these options provide educational resources and community support, which can be invaluable for those new to budgeting.

Advanced Budget Planner Options for Financial Experts

| Features | Benefits |

|---|---|

| Customizable Budget Categories | Allows financial experts to tailor budget categories to specific client needs |

| Advanced Forecasting Tools | Enables accurate prediction of future financial trends and outcomes |

| Integration with Financial Software | Seamlessly connects with existing financial software for streamlined data management |

| Multi-Currency Support | Facilitates budget planning for clients with international investments or transactions |

| Collaboration and Sharing Features | Allows financial experts to collaborate with clients and share budget plans in real-time |

For seasoned financial planners or individuals with more complex financial situations, advanced budget planners offer sophisticated features that cater to detailed financial analysis. One such option is “YNAB” (You Need A Budget), which goes beyond traditional budgeting by incorporating principles of proactive money management. YNAB encourages users to assign every dollar a job and emphasizes the importance of adjusting budgets based on real-time spending patterns.

Its robust reporting tools provide insights into spending trends over time, enabling users to make informed decisions about their finances. Another advanced option is “Mint,” which not only allows users to create budgets but also tracks investments and net worth. Mint aggregates financial data from various accounts, providing a comprehensive view of one’s financial landscape.

This feature is particularly beneficial for individuals managing multiple income streams or investments, as it allows for holistic financial planning. Additionally, Mint offers personalized tips based on spending habits, helping users optimize their budgets further.

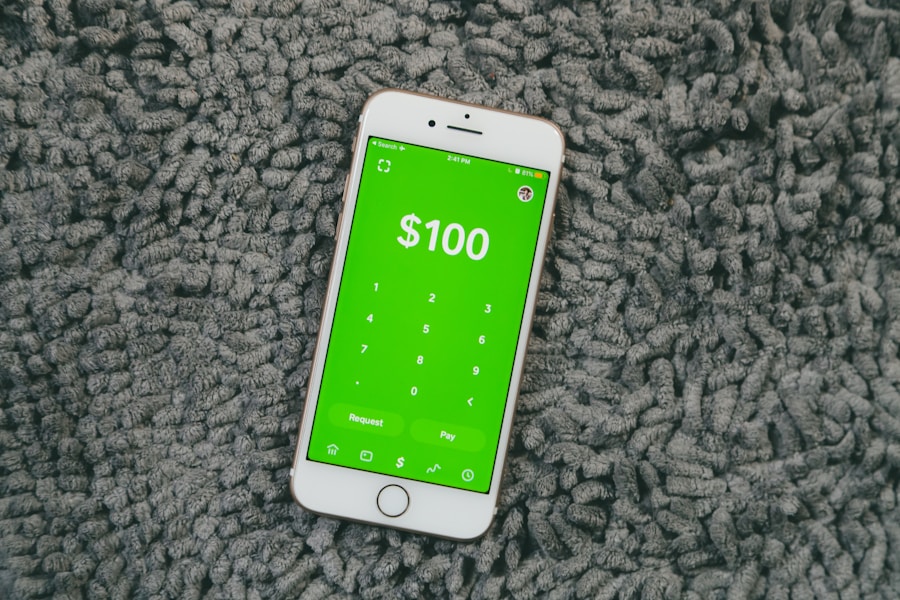

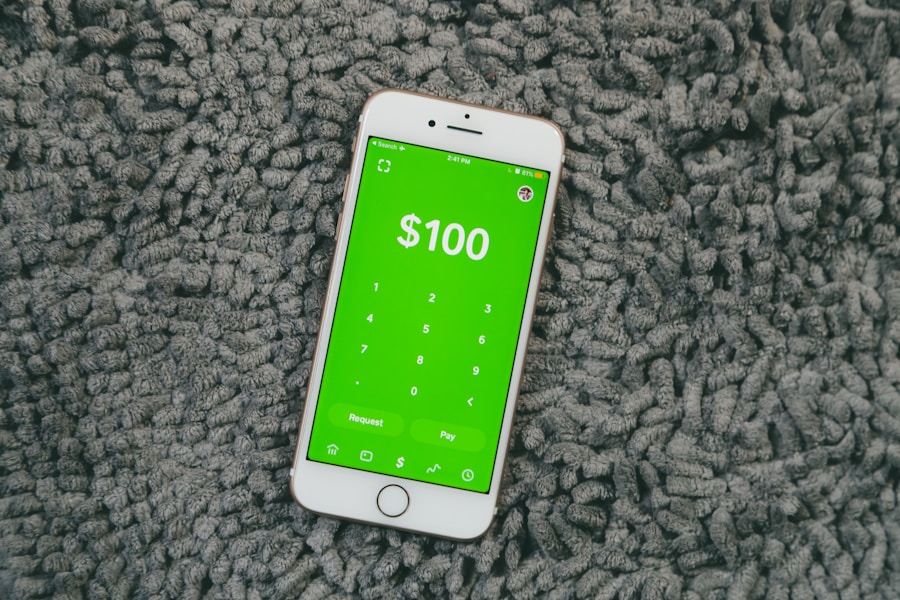

The choice between using a budget planner app or a physical planner often comes down to personal preference and lifestyle. Budget planner apps offer convenience and accessibility; they can be used on-the-go and often come with features like automatic expense tracking through bank integration. This real-time data entry can significantly reduce the time spent on manual calculations and updates.

Furthermore, many apps provide reminders and alerts for upcoming bills or budget limits, helping users stay on track without constant vigilance. On the other hand, physical planners have their own set of advantages that appeal to tactile learners or those who prefer a more traditional approach. Writing down expenses can enhance memory retention and provide a sense of accomplishment as users physically check off completed tasks.

Additionally, physical planners allow for greater customization; users can incorporate stickers, color coding, or personal notes that reflect their unique style and preferences. However, they lack the automation and analytical capabilities of digital apps, which may require more effort in terms of data entry and tracking.

How to Stick to Your Budget Using a Budget Planner

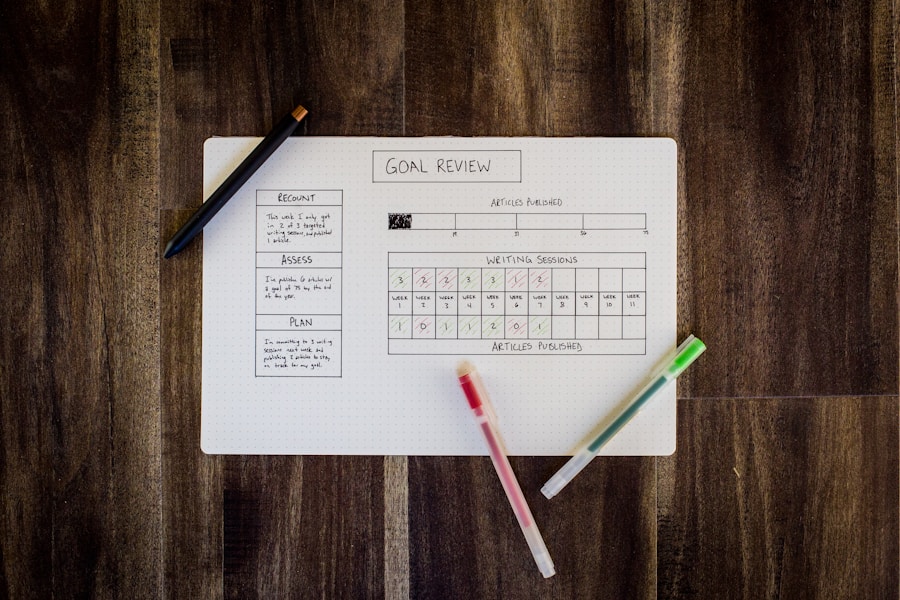

Sticking to a budget can be challenging, but utilizing a budget planner effectively can significantly enhance adherence to financial goals. One effective strategy is to set realistic and achievable goals within the planner. Instead of aiming for drastic cuts in spending overnight, individuals should focus on incremental changes that are sustainable over time.

For example, if dining out frequently is a concern, setting a specific limit for restaurant expenses each month can help create a manageable target. Regularly reviewing the budget is another crucial aspect of maintaining discipline. Setting aside time each week or month to assess spending against the budget allows individuals to identify trends and make necessary adjustments proactively.

This practice not only keeps users accountable but also reinforces the habit of mindful spending. Additionally, celebrating small victories—such as successfully saving for a desired purchase—can motivate individuals to continue adhering to their budget.

Customizing Your Budget Planner to Fit Your Financial Goals

Customization is key when it comes to maximizing the effectiveness of a budget planner. Each individual has unique financial circumstances and aspirations; therefore, tailoring the planner to reflect personal goals can enhance motivation and engagement. For instance, if saving for retirement is a priority, incorporating specific savings targets within the planner can help track progress toward that goal.

Users might create dedicated sections for retirement contributions or investment tracking within their planners. Moreover, incorporating personal values into the budgeting process can make it more meaningful. If an individual values philanthropy or community involvement, they might allocate a portion of their budget specifically for charitable donations or volunteer-related expenses.

This alignment between budgeting and personal values fosters a sense of purpose in financial management and encourages individuals to stick with their plans even when faced with challenges.

Tips for Maximizing the Effectiveness of Your Budget Planner

To truly harness the power of a budget planner, several strategies can be employed to maximize its effectiveness. First and foremost, consistency is vital; regularly updating the planner with income and expenses ensures that it remains an accurate reflection of one’s financial situation. Setting reminders or establishing a routine for this task can help integrate budgeting into daily life seamlessly.

Additionally, leveraging technology can enhance the budgeting experience significantly. Many budget planner apps offer features such as syncing with bank accounts or automatic transaction categorization, which can save time and reduce errors in data entry. Users should take advantage of these tools while still maintaining an active role in reviewing their finances regularly.

Finally, seeking support from communities or forums focused on budgeting can provide valuable insights and encouragement. Engaging with others who share similar financial goals can foster accountability and inspire new strategies for effective budgeting. Whether through online platforms or local groups, connecting with like-minded individuals can enhance motivation and provide fresh perspectives on managing finances effectively.

In conclusion, understanding the nuances of budgeting through effective planning tools can empower individuals to take control of their financial futures. By selecting the right planner—be it digital or physical—and customizing it to fit personal goals while employing consistent practices, anyone can navigate their financial landscape with confidence and clarity.

If you are looking for the best budget planner, you may also be interested in learning how to make a budget tracker in Excel. This article from Valapoint provides easy steps to create a personalized budget tracker using Excel, which can be a great tool for managing your finances. Check out the article here for more information on how to effectively track your expenses and savings.