To effectively manage your finances, it is crucial to have a clear understanding of your income and expenses. Income refers to the money you receive, which can come from various sources such as salaries, bonuses, rental income, dividends, or side hustles. On the other hand, expenses encompass all the costs you incur in your daily life, including fixed expenses like rent or mortgage payments, utilities, and insurance, as well as variable expenses such as groceries, entertainment, and discretionary spending.

By gaining a comprehensive view of both your income and expenses, you can begin to identify patterns and make informed decisions about your financial future. One effective method for understanding your financial situation is to create a detailed income and expense statement. This document should list all sources of income and categorize your expenses into fixed and variable sections.

For instance, if you earn a monthly salary of $4,000, you might have fixed expenses totaling $2,500 (including rent, utilities, and insurance) and variable expenses averaging $1,000 (covering groceries, dining out, and entertainment). The remaining $500 could be allocated towards savings or debt repayment. By visualizing your financial landscape in this way, you can pinpoint areas where you may be overspending or where you have room to increase savings.

Key Takeaways

- Know your income and expenses to gain control over your finances.

- Set clear, achievable financial goals to guide your budgeting efforts.

- Create and stick to a budget to manage your money effectively.

- Track your spending regularly to identify and reduce unnecessary expenses.

- Build an emergency fund and manage debt to ensure financial stability and invest wisely for future growth.

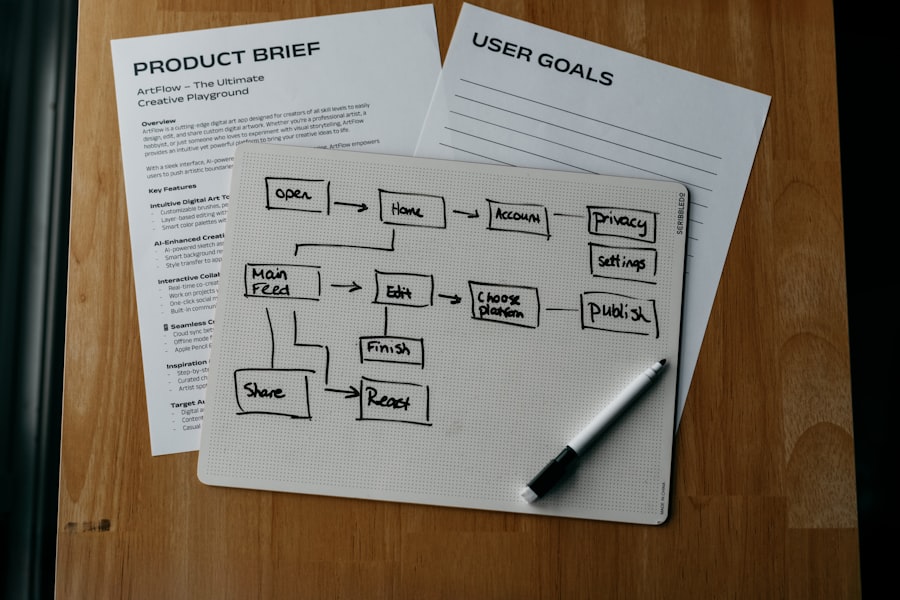

Setting Financial Goals

Once you have a firm grasp of your income and expenses, the next step is to set clear financial goals. Financial goals serve as a roadmap for your financial journey, providing direction and motivation. These goals can be short-term, such as saving for a vacation or paying off a credit card, medium-term, like saving for a down payment on a house, or long-term, such as planning for retirement.

The key to effective goal-setting is to ensure that your goals are specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of simply stating that you want to save money for a vacation, a SMART goal would be: “I will save $2,000 for a vacation to Hawaii within the next 12 months by setting aside $167 each month.” This level of specificity not only clarifies what you are working towards but also establishes a timeline and a concrete plan for achieving it. Additionally, it is essential to regularly review and adjust your financial goals as circumstances change.

Life events such as job changes, family growth, or unexpected expenses can impact your ability to meet your goals, so flexibility is vital.

Creating a Budget

Creating a budget is an essential step in managing your finances effectively. A budget acts as a financial blueprint that outlines how much money you have coming in and how much you plan to spend over a specific period. It helps you allocate funds toward necessary expenses while also allowing for savings and discretionary spending.

There are various budgeting methods available, including the zero-based budget, the 50/30/20 rule, and the envelope system. Each method has its advantages and can be tailored to fit individual preferences. The zero-based budget requires you to assign every dollar of your income to specific expenses or savings categories until there is no money left unallocated.

This approach encourages mindfulness about spending and ensures that every dollar serves a purpose. Alternatively, the 50/30/20 rule suggests allocating 50% of your income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings and debt repayment. This method provides a balanced approach that allows for both responsible spending and saving.

Whichever budgeting method you choose, the key is consistency; regularly updating and reviewing your budget will help you stay on track.

Tracking Your Spending

Tracking your spending is an integral part of maintaining financial health. It involves monitoring where your money goes each month and comparing it against your budget. By keeping a close eye on your expenditures, you can identify trends in your spending habits and make adjustments as necessary.

There are numerous tools available for tracking spending, ranging from simple spreadsheets to sophisticated budgeting apps that automatically categorize transactions. For instance, if you notice that you consistently overspend on dining out each month, this insight allows you to make informed decisions about where to cut back. Perhaps you could limit dining out to once a week or set a specific budget for meals outside the home.

Additionally, tracking spending can help you identify subscriptions or recurring charges that may no longer serve you. By canceling unused services or negotiating better rates on existing ones, you can free up additional funds for savings or debt repayment.

Identifying Areas for Improvement

|

|

| Category |

Monthly Budget |

Amount Spent |

Remaining Budget |

Percentage Used |

| Housing |

1200 |

1150 |

50 |

95.8% |

| Food |

500 |

450 |

50 |

90.0% |

| Transportation |

300 |

280 |

20 |

93.3% |

| Entertainment |

150 |

100 |

50 |

66.7% |

| Utilities |

200 |

190 |

10 |

95.0% |

| Healthcare |

100 |

80 |

20 |

80.0% |

| Miscellaneous |

100 |

60 |

40 |

60.0% |

Once you have tracked your spending for several months, it becomes easier to identify areas for improvement in your financial habits. This process involves analyzing your spending patterns and determining where adjustments can be made to align with your financial goals.

For example, if you find that a significant portion of your budget is allocated to entertainment expenses but you are struggling to save for an emergency fund, it may be time to reassess those priorities.

Consider implementing strategies such as reducing discretionary spending or finding more cost-effective alternatives for entertainment. Instead of going out for dinner every weekend, hosting potluck dinners with friends can provide social interaction without the hefty price tag. Additionally, evaluating fixed expenses can yield opportunities for savings; shopping around for better insurance rates or negotiating lower bills can result in significant savings over time.

Managing Debt

Managing debt is a critical aspect of financial health that requires careful planning and strategy. High levels of debt can hinder progress toward financial goals and create stress in daily life. To effectively manage debt, it is essential first to understand the types of debt you have—whether it be credit card debt, student loans, personal loans, or mortgages—and their respective interest rates.

This knowledge allows you to prioritize which debts to tackle first. One common strategy for managing debt is the snowball method, where you focus on paying off the smallest debts first while making minimum payments on larger debts. This approach can provide psychological benefits by creating quick wins that motivate continued progress.

Alternatively, the avalanche method prioritizes debts with the highest interest rates first, potentially saving more money in interest payments over time. Whichever method you choose, consistency in making payments is crucial; setting up automatic payments can help ensure that debts are paid on time.

Building an Emergency Fund

An emergency fund serves as a financial safety net that can protect you from unexpected expenses such as medical emergencies, car repairs, or job loss. Financial experts typically recommend saving three to six months’ worth of living expenses in an easily accessible account. Building this fund requires discipline and commitment but can provide peace of mind knowing that you are prepared for unforeseen circumstances.

To start building an emergency fund, consider setting aside a small percentage of each paycheck specifically for this purpose. Automating transfers from your checking account to a dedicated savings account can make this process seamless. Additionally, consider using any windfalls—such as tax refunds or bonuses—to boost your emergency fund more quickly.

Over time, having this cushion will not only help you navigate financial challenges but also reduce reliance on credit cards or loans during emergencies.

Investing for the Future

Investing is a vital component of long-term financial planning that allows individuals to grow their wealth over time. Unlike saving—where money typically sits in low-interest accounts—investing involves purchasing assets such as stocks, bonds, mutual funds, or real estate with the expectation that they will appreciate in value over time. The earlier one starts investing, the more time their money has to grow due to the power of compound interest.

Before diving into investing, it is essential to educate yourself about different investment vehicles and strategies. For instance, stocks tend to offer higher potential returns but come with increased risk compared to bonds or savings accounts. Diversification—spreading investments across various asset classes—can help mitigate risk while still allowing for growth potential.

Additionally, consider utilizing tax-advantaged accounts such as 401(k)s or IRAs to maximize retirement savings while minimizing tax liabilities. Investing also requires ongoing monitoring and adjustment based on market conditions and personal financial goals. Regularly reviewing your investment portfolio ensures that it aligns with your risk tolerance and long-term objectives.

As life circumstances change—such as marriage, children, or career shifts—your investment strategy may need to adapt accordingly to remain effective in achieving your financial aspirations. By understanding income and expenses, setting clear financial goals, creating a budget, tracking spending habits, identifying areas for improvement, managing debt effectively, building an emergency fund, and investing wisely for the future, individuals can take control of their financial lives and work towards achieving their long-term aspirations with confidence.

If you’re looking to take control of your finances, an expense tracker can be an invaluable tool. For those interested in mastering their budgeting skills, you might find the article on Additionally, integrating reminders or alerts can serve as helpful nudges to ensure that tracking remains a priority.

Categorizing Your Expenses

Categorizing expenses is an essential aspect of effective expense tracking that allows individuals to gain deeper insights into their spending habits. By grouping expenditures into distinct categories, one can easily identify areas where spending may be excessive or unnecessary. Common categories include fixed expenses like rent or mortgage payments, variable expenses such as groceries and dining out, and discretionary spending on entertainment or hobbies.

This classification not only aids in understanding where money is going but also facilitates more informed budgeting decisions. Furthermore, the process of categorization can reveal trends over time. For example, an individual may notice that their dining out expenses consistently exceed their budgeted amount.

This realization can prompt a reassessment of priorities and lead to more conscious choices regarding eating out versus cooking at home. Additionally, some expense trackers allow users to create subcategories for even more granular insights; for instance, breaking down entertainment spending into movies, concerts, and subscriptions can highlight specific areas for potential savings. Ultimately, effective categorization empowers individuals to take charge of their finances by providing clarity and direction.

Analyzing Your Spending Patterns

|

|

| Category |

Monthly Budget |

Amount Spent |

Remaining Budget |

Percentage Used |

| Housing |

1200 |

1150 |

50 |

95.8% |

| Food |

500 |

450 |

50 |

90% |

| Transportation |

300 |

280 |

20 |

93.3% |

| Entertainment |

150 |

100 |

50 |

66.7% |

| Utilities |

200 |

190 |

10 |

95% |

| Healthcare |

100 |

80 |

20 |

80% |

| Miscellaneous |

100 |

60 |

40 |

60% |

Once expenses have been tracked and categorized, the next logical step is analyzing spending patterns. This analysis involves reviewing the data collected over time to identify trends and behaviors that may warrant attention.

For instance, an individual might discover that they tend to overspend during certain months or seasons—perhaps due to holiday shopping or summer vacations.

Recognizing these patterns enables proactive planning for future expenditures and helps mitigate the risk of financial strain. Moreover, analyzing spending patterns can uncover opportunities for savings that may not have been previously considered. For example, if someone notices that they frequently purchase new clothes but rarely wear them, it may be time to reassess their clothing budget or adopt a more minimalist approach to shopping.

Additionally, this analysis can inform decisions about lifestyle changes; if an individual finds that they spend excessively on entertainment but derive little satisfaction from it, they might choose to explore free or low-cost activities instead. By engaging in regular analysis of spending patterns, individuals can cultivate a more intentional approach to their finances.

Creating a Budget Based on Your Expenses

Creating a budget based on tracked expenses is a natural progression in the financial management process. A well-structured budget serves as a roadmap for future spending and saving decisions, helping individuals align their financial goals with their actual behavior. To create an effective budget, one must first review the categorized expenses and determine which areas are essential versus discretionary.

This distinction allows for prioritization of necessary expenditures while identifying potential areas for reduction. When formulating a budget, it is beneficial to adopt the 50/30/20 rule as a guiding principle: allocate 50% of income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings and debt repayment. However, this framework should be adjusted based on individual circumstances; for instance, someone living in an area with high housing costs may need to allocate more than 50% to needs.

The key is to create a budget that feels realistic and sustainable while still challenging enough to encourage positive financial habits.

Using Your Expense Tracker to Reach Financial Goals

An expense tracker can be an invaluable tool in the pursuit of financial goals. By providing clarity on current spending habits and highlighting areas for improvement, it empowers individuals to make informed decisions that align with their aspirations. For example, if someone’s goal is to save for a vacation, they can use their expense tracker to identify discretionary spending that could be reduced or eliminated altogether—perhaps cutting back on dining out or subscription services.

Additionally, many expense trackers offer features that allow users to set specific savings goals within the app itself. This functionality can serve as motivation by visually representing progress toward the goal. For instance, if an individual aims to save $1,000 for a vacation within six months, they can track their contributions toward this goal each month and adjust their budget accordingly if they fall behind.

By leveraging the insights gained from expense tracking in conjunction with goal-setting features, individuals can create actionable plans that lead them closer to achieving their financial dreams.

Tips for Maintaining Your Expense Tracker

Maintaining an expense tracker requires commitment and consistency; however, there are several strategies that can simplify this process and enhance its effectiveness. One key tip is to establish a regular schedule for updating the tracker—whether daily or weekly—so that it becomes an integral part of one’s routine. Setting aside dedicated time each week to review transactions not only ensures accuracy but also reinforces accountability in managing finances.

Another helpful strategy is to automate as much of the tracking process as possible. Many modern expense trackers allow users to link their bank accounts or credit cards directly to the app, automatically importing transactions and categorizing them accordingly. This feature significantly reduces the manual effort required while also minimizing the risk of forgetting expenses.

However, it remains essential to periodically review these automated entries for accuracy and make adjustments as needed. Additionally, staying engaged with the expense tracker by regularly reviewing progress toward financial goals can foster motivation and commitment. Celebrating small victories—such as reaching a savings milestone or successfully reducing discretionary spending—can reinforce positive behaviors and encourage continued diligence in tracking expenses.

By implementing these tips and maintaining an active relationship with their expense tracker, individuals can cultivate lasting financial discipline and achieve greater control over their financial futures.

If you’re looking to manage your finances more effectively, an expense tracker can be a great tool. For additional insights on budgeting, you might find this article on the This could be as simple as reviewing receipts at the end of each day or dedicating time on Sunday evenings to reflect on the week’s spending.

By integrating expense tracking into one’s regular schedule, it becomes less of a chore and more of a natural part of financial management.

Categorizing Expenses for Easy Tracking

Once a system for tracking expenses is in place, the next step involves categorizing those expenses for easier analysis. Categorization allows individuals to see not just how much they are spending overall but also where their money is going. Common categories include housing, transportation, groceries, entertainment, and savings.

By breaking down expenses into these segments, individuals can quickly identify areas where they may be overspending or where adjustments can be made. For instance, someone might categorize their monthly expenses into fixed costs—such as rent or mortgage payments—and variable costs—like dining out or shopping. This distinction can be particularly enlightening; fixed costs are often non-negotiable, while variable costs present opportunities for savings.

By analyzing these categories over time, individuals can make informed decisions about where to cut back without sacrificing their quality of life. For example, if entertainment expenses are consistently high, one might consider opting for free community events or hosting potlucks instead of dining out.

Utilizing Technology for Expense Tracking

In today’s digital age, technology offers numerous tools and applications designed to simplify the process of expense tracking. These tools can automate many aspects of tracking, making it easier to stay on top of finances without the burden of manual entry. Popular applications like Mint, YNAB (You Need A Budget), and PocketGuard allow users to link their bank accounts and credit cards directly to the app, automatically categorizing transactions and providing real-time insights into spending habits.

Moreover, these applications often come equipped with features that enhance financial awareness. For instance, many offer budgeting tools that allow users to set limits on specific categories and receive alerts when they approach those limits. This proactive approach not only aids in maintaining discipline but also encourages users to think critically about their spending choices.

Additionally, some apps provide visual representations of spending trends through graphs and charts, making it easier to grasp complex financial data at a glance.

Creating a Budget Based on Tracked Expenses

|

|

| Metric |

Description |

How to Track |

Tools/Methods |

| Total Monthly Expenses |

The sum of all expenses incurred in a month |

Record all expenses and sum them up at month-end |

Spreadsheets, Expense tracking apps |

| Category-wise Spending |

Expenses broken down by categories like food, transport, utilities |

Assign each expense to a category when recording |

Budgeting apps, Manual categorization in spreadsheets |

| Daily Expense Average |

Average amount spent per day |

Total monthly expenses divided by number of days |

Calculator, Expense tracking apps |

| Recurring Expenses |

Regular expenses that occur monthly or periodically |

Identify and list fixed payments like rent, subscriptions |

Calendar reminders, Budgeting software |

| Unplanned Expenses |

Unexpected or emergency expenses |

Track expenses not part of regular budget categories |

Manual notes, Expense apps with notes feature |

| Expense to Income Ratio |

Percentage of income spent |

Divide total expenses by total income and multiply by 100 |

Spreadsheets, Financial calculators |

| Cash vs Card Spending |

Comparison of expenses paid by cash and card |

Record payment method for each expense |

Expense tracking apps, Manual logs |

Once expenses have been tracked and categorized, the next logical step is creating a budget that reflects this data. A well-structured budget serves as a roadmap for financial decision-making and helps individuals allocate their resources effectively. The process begins by analyzing tracked expenses to determine average monthly spending in each category.

This analysis provides a foundation upon which to build a realistic budget that aligns with one’s financial goals. When creating a budget, it is crucial to differentiate between needs and wants.

Needs are essential expenses such as housing, utilities, and groceries, while wants encompass discretionary spending like entertainment and dining out.

By prioritizing needs in the budget and allocating a reasonable amount for wants, individuals can create a balanced financial plan that allows for both responsible spending and enjoyment. Additionally, incorporating savings into the budget—whether for emergencies or future goals—ensures that financial stability is maintained even in unpredictable circumstances.

Tips for Staying Consistent with Expense Tracking

Maintaining consistency in expense tracking can be challenging, especially as life becomes busy and chaotic. However, there are several strategies that can help individuals stay committed to this important practice. One effective approach is to set reminders or alerts on smartphones or calendars to prompt regular updates.

These reminders can serve as gentle nudges to review expenses and ensure that tracking remains a priority. Another helpful tip is to simplify the tracking process as much as possible. For instance, carrying a small notebook or using an app on one’s phone can make it easier to record expenses on the go rather than waiting until later when details may be forgotten.

Additionally, establishing accountability by sharing financial goals with friends or family members can provide motivation to stay consistent with tracking efforts. Engaging in discussions about finances can foster a supportive environment where individuals encourage each other to remain diligent in their expense tracking endeavors.

Analyzing Tracked Expenses for Financial Planning

Once sufficient data has been collected through expense tracking, it becomes essential to analyze this information for effective financial planning. This analysis involves reviewing spending patterns over time and identifying trends that may impact future financial decisions. For example, if an individual notices that their grocery expenses have steadily increased over several months, it may prompt them to explore ways to reduce costs—such as meal planning or shopping sales.

Furthermore, analyzing tracked expenses can reveal opportunities for investment or savings that may have previously gone unnoticed. For instance, if someone consistently spends less than budgeted in certain categories, they might consider reallocating those funds toward savings or investments rather than allowing them to slip away unnoticed. This proactive approach not only enhances financial literacy but also empowers individuals to take control of their financial futures by making informed decisions based on concrete data.

Adjusting Expenses Based on Tracked Data

The final step in the expense tracking process involves making adjustments based on the insights gained from analyzed data. Financial circumstances are rarely static; therefore, flexibility is key when it comes to managing expenses effectively. If tracked data indicates that certain categories consistently exceed budgeted amounts—such as entertainment or dining out—it may be necessary to reassess priorities and make conscious choices about spending in those areas.

Conversely, if an individual finds themselves consistently under budget in specific categories, they might consider reallocating those funds toward savings or investments that align with their long-term goals. This adaptability ensures that financial plans remain relevant and responsive to changing circumstances. By regularly reviewing tracked expenses and making necessary adjustments, individuals can cultivate healthier financial habits that lead to greater stability and peace of mind in their financial lives.

To effectively track your expenses, it’s essential to choose the right budgeting tools that suit your needs. A helpful resource for this is the article on mastering your finances, which provides insights into the best budget planner picks. You can read more about it here. This article can guide you in selecting a planner that will help you keep your expenses in check and achieve your financial goals.

FAQs

What is expense tracking?

Expense tracking is the process of recording and monitoring all your spending to understand where your money goes. It helps in managing budgets and improving financial planning.

Why is it important to track expenses?

Tracking expenses allows you to identify spending patterns, control unnecessary expenditures, save money, and achieve financial goals more effectively.

What are common methods to track expenses?

Common methods include using spreadsheets, mobile apps, budgeting software, or maintaining a physical expense journal.

Can I track expenses manually without technology?

Yes, you can track expenses manually by writing down all your expenditures in a notebook or ledger, though it may be less efficient than digital methods.

How often should I track my expenses?

It is recommended to track expenses daily or weekly to maintain accurate records and stay on top of your budget.

What information should I record when tracking expenses?

You should record the date, amount spent, category (e.g., food, transportation), payment method, and any relevant notes.

Are there free tools available for expense tracking?

Yes, many free apps and spreadsheet templates are available for expense tracking, such as Mint, YNAB (You Need A Budget), and Google Sheets.

How can tracking expenses help with budgeting?

By knowing exactly where your money goes, you can create realistic budgets, identify areas to cut costs, and allocate funds more effectively.

Is it necessary to track every small expense?

While tracking every expense provides the most accurate picture, some people choose to track only significant or recurring expenses to simplify the process.

Can expense tracking improve financial habits?

Yes, regular expense tracking increases financial awareness, encourages mindful spending, and helps build better money management habits.