Establishing clear and achievable goals is a fundamental step in any financial planning process. Goals provide direction and purpose, allowing individuals to focus their efforts on specific outcomes. When setting these goals, it is essential to ensure they are both realistic and measurable. For instance, rather than simply stating a desire to “save money,” a more effective goal would be to “save $5,000 for a vacation within the next year.” This specificity not only clarifies the objective but also allows for easier tracking of progress.

Moreover, breaking down larger goals into smaller, manageable milestones can enhance motivation and provide a sense of accomplishment along the way. For example, if the overarching goal is to save for a home down payment, one might set intermediate targets such as saving a certain amount each month or reaching specific savings thresholds at various points throughout the year. This incremental approach can help maintain focus and commitment, making the overall goal feel less daunting and more attainable.

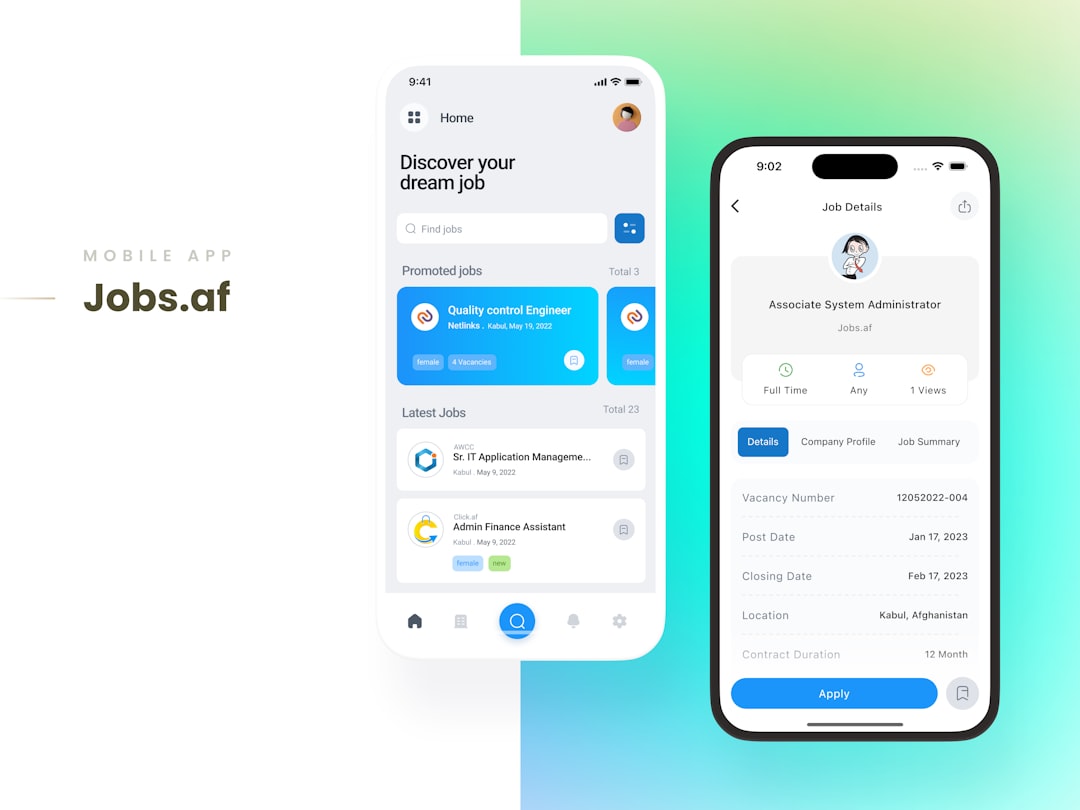

If you’re interested in effective strategies for saving money, you might find the article on goal savings particularly insightful.

It discusses various methods to set and achieve your financial objectives, making it easier to reach your savings targets.

You can read more about it here: Goal Savings Strategies.

Key Takeaways

- Set specific, realistic financial goals to guide your savings journey.

- Develop and stick to a detailed budget to manage income and expenses effectively.

- Cut out non-essential spending to increase your savings potential.

- Use automation and savings accounts to consistently build your savings effortlessly.

- Monitor your progress regularly and celebrate achievements to stay motivated.

Creating a Budget Plan

A budget plan serves as a financial roadmap, guiding individuals in their spending and saving habits. To create an effective budget, one must first assess their income and expenses comprehensively. This involves listing all sources of income, including salaries, bonuses, and any side hustles, followed by a detailed account of monthly expenses such as rent, utilities, groceries, and discretionary spending. By understanding where money comes from and where it goes, individuals can make informed decisions about their financial priorities.

Once the income and expenses are outlined, the next step is to categorize these expenses into fixed and variable costs. Fixed costs are those that remain constant each month, such as rent or mortgage payments, while variable costs can fluctuate, like dining out or entertainment. This categorization allows for better control over spending habits. After identifying these categories, individuals can allocate funds accordingly, ensuring that essential expenses are covered while also designating amounts for savings and discretionary spending. A well-structured budget not only helps in managing finances but also fosters a sense of accountability.

Identifying and Eliminating Unnecessary Expenses

Identifying unnecessary expenses is crucial for effective financial management. Many individuals may not realize how small, recurring costs can accumulate over time, leading to significant financial strain. A thorough review of monthly expenditures can reveal subscriptions or services that are no longer used or needed. For instance, an unused gym membership or streaming service can be eliminated to free up funds for more important financial goals.

In addition to cutting out unused services, individuals should also evaluate their spending habits in areas such as dining out or entertainment. By tracking these expenses over a month or two, one can identify patterns and determine where adjustments can be made. For example, opting for home-cooked meals instead of frequent restaurant visits can lead to substantial savings. By consciously choosing to eliminate or reduce unnecessary expenses, individuals can redirect those funds toward savings or investments that align with their financial goals.

Automating Savings Contributions

Automating savings contributions is an effective strategy for ensuring consistent progress toward financial goals. By setting up automatic transfers from checking accounts to savings accounts, individuals can make saving a seamless part of their financial routine. This method reduces the temptation to spend money that could otherwise be saved and helps build a savings habit over time.

To implement automation effectively, individuals should first determine a comfortable amount to save each month. This amount should align with their overall budget and financial goals. Once established, setting up automatic transfers on payday or at regular intervals can simplify the process. Many banks offer features that allow customers to automate these transfers easily. By removing the manual effort involved in saving, individuals are more likely to stick to their savings plans and achieve their financial objectives.

If you’re looking to enhance your financial planning, understanding how to effectively manage your expenses can be crucial for achieving your savings goals. A related article on business expense tracking provides valuable insights that can help you streamline your finances and allocate more towards your savings. You can read more about it in this informative piece on business expense tracking, which offers practical tips and strategies to improve your overall financial health.

Utilizing Savings Tools and Accounts

| Month | Target Savings | Actual Savings | Percentage of Goal Achieved | Notes |

|---|---|---|---|---|

| January | 500 | 450 | 90% | Missed target due to unexpected expenses |

| February | 500 | 520 | 104% | Exceeded goal by cutting discretionary spending |

| March | 500 | 500 | 100% | On track with planned savings |

| April | 500 | 480 | 96% | Close to target, slight shortfall |

| May | 500 | 530 | 106% | Bonus received helped exceed goal |

Utilizing various savings tools and accounts can enhance the effectiveness of a savings strategy. High-yield savings accounts, for example, offer better interest rates than traditional savings accounts, allowing funds to grow more efficiently over time. These accounts are typically offered by online banks and can provide a safe place for emergency funds or short-term savings goals.

In addition to high-yield accounts, individuals may consider using budgeting apps or financial management software to track their savings progress. These tools often provide insights into spending habits and help users stay accountable to their budgets. Some apps even allow users to set specific savings goals and monitor their progress visually. By leveraging these resources, individuals can optimize their savings efforts and make informed decisions about their finances.

Staying Motivated and Focused

Maintaining motivation and focus on financial goals can be challenging over time. One effective way to stay engaged is by regularly revisiting and visualizing the goals set at the beginning of the process. Creating a vision board or using digital tools to visualize milestones can serve as constant reminders of what one is working toward. This visual representation can reignite enthusiasm and commitment when motivation wanes.

Additionally, finding an accountability partner can provide external support and encouragement. Sharing financial goals with a friend or family member can create a sense of responsibility and foster discussions about progress and challenges faced along the way. Regular check-ins with this partner can help maintain focus and provide opportunities for celebrating small victories together.

Tracking Progress and Adjusting Goals

Tracking progress is essential for understanding how well one is adhering to their budget and achieving their financial goals. Regularly reviewing financial statements and comparing them against set targets allows individuals to assess their performance objectively. This practice not only highlights successes but also identifies areas where adjustments may be necessary.

As circumstances change—whether due to shifts in income, unexpected expenses, or changes in personal priorities—goals may need to be adjusted accordingly. Flexibility is key in financial planning; what was once an achievable target may no longer be realistic due to life changes. By being open to reassessing goals and making necessary adjustments, individuals can maintain a proactive approach to their finances rather than becoming discouraged by setbacks.

Celebrating Milestones and Successes

Celebrating milestones and successes is an important aspect of maintaining motivation in any financial journey. Recognizing achievements—no matter how small—can reinforce positive behaviors and encourage continued progress toward larger goals. For instance, reaching a savings milestone or successfully sticking to a budget for several months warrants acknowledgment.

Celebrations need not be extravagant; simple rewards such as treating oneself to a favorite meal or enjoying a day off can serve as effective motivators. By incorporating celebrations into the financial journey, individuals create positive associations with saving and budgeting efforts. This practice not only enhances motivation but also fosters a healthier relationship with money over time.

In conclusion, effective financial management involves setting clear goals, creating structured budgets, eliminating unnecessary expenses, automating savings contributions, utilizing appropriate tools, staying motivated, tracking progress, and celebrating achievements. By following these steps diligently, individuals can work toward achieving their financial objectives while fostering a sense of accomplishment along the way.

FAQs

What is goal savings?

Goal savings is a financial strategy where individuals set aside money specifically to achieve a particular financial objective, such as buying a house, going on vacation, or building an emergency fund.

How do I set effective savings goals?

To set effective savings goals, define a clear and specific target amount, set a realistic timeline, and create a budget that allows you to consistently contribute towards your goal.

What are the benefits of goal savings?

Goal savings helps improve financial discipline, provides motivation to save regularly, reduces the likelihood of impulsive spending, and ensures funds are available for planned expenses.

Can goal savings be automated?

Yes, many banks and financial apps offer automated savings plans where a fixed amount is transferred regularly from your checking account to a dedicated savings account, making it easier to stay on track.

What types of accounts are best for goal savings?

High-yield savings accounts, money market accounts, and certificates of deposit (CDs) are commonly used for goal savings because they offer safety and some interest earnings, helping your money grow over time.