To effectively manage your finances, it is crucial to have a comprehensive understanding of your income and expenses. Income refers to the money you receive, which can come from various sources such as salaries, bonuses, rental income, dividends, or side hustles. On the other hand, expenses encompass all the costs you incur in your daily life, including fixed expenses like rent or mortgage payments, utilities, and insurance, as well as variable expenses such as groceries, entertainment, and discretionary spending.

By gaining clarity on these two fundamental components of your financial landscape, you can begin to make informed decisions about your money. A detailed analysis of your income and expenses can reveal patterns that may not be immediately apparent. For instance, you might discover that while your salary is stable, your spending on dining out or subscription services has increased significantly over time.

This awareness can prompt you to reassess your priorities and make adjustments where necessary. Additionally, understanding the difference between needs and wants is essential; needs are the essentials required for survival and basic functioning, while wants are non-essential items that enhance your quality of life. By categorizing your expenses accordingly, you can better allocate your resources and work towards achieving financial stability.

Key Takeaways

- Understanding your income and expenses is the first step to taking control of your finances.

- Setting clear financial goals will help you stay focused and motivated to achieve them.

- Tracking your spending is essential to understand where your money is going and identify areas for improvement.

- Creating a realistic budget that aligns with your financial goals is crucial for financial success.

- Identifying areas for cost cutting can help you free up more money to put towards your financial goals.

Setting Clear Financial Goals

Once you have a firm grasp of your income and expenses, the next step is to set clear financial goals. These goals serve as a roadmap for your financial journey and can vary widely depending on individual circumstances. Some common financial goals include saving for retirement, purchasing a home, funding a child’s education, or paying off debt.

The key to effective goal-setting is to ensure that your objectives are specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of vaguely stating that you want to save money, you might set a goal to save $10,000 for a down payment on a house within the next three years. Establishing clear financial goals not only provides direction but also motivates you to stay disciplined in your spending habits.

When you have a tangible target in mind, it becomes easier to make sacrifices in other areas of your budget. For instance, if your goal is to save for a vacation, you may choose to cut back on dining out or limit impulse purchases. Furthermore, regularly reviewing and updating your goals can help you stay aligned with your evolving financial situation and aspirations.

As life circumstances change—such as a new job opportunity or unexpected expenses—adapting your goals ensures that they remain relevant and achievable.

Tracking Your Spending

Tracking your spending is an essential practice for anyone looking to gain control over their finances. By meticulously recording every expense, you can identify where your money is going and uncover any potential areas of overspending. There are various methods for tracking expenses, ranging from traditional pen-and-paper methods to modern budgeting apps that automatically categorize transactions.

Regardless of the method chosen, consistency is key; regularly updating your records will provide you with an accurate picture of your financial habits. In addition to simply recording expenses, analyzing this data can yield valuable insights. For example, you may find that a significant portion of your budget is allocated to coffee shops or takeout meals.

Recognizing these trends allows you to make informed decisions about where to cut back without feeling deprived. Moreover, tracking spending can help you identify recurring charges that may no longer serve you—such as unused gym memberships or subscription services—enabling you to eliminate unnecessary costs. Ultimately, this practice fosters greater awareness of your financial behavior and empowers you to make more intentional choices.

Creating a Realistic Budget

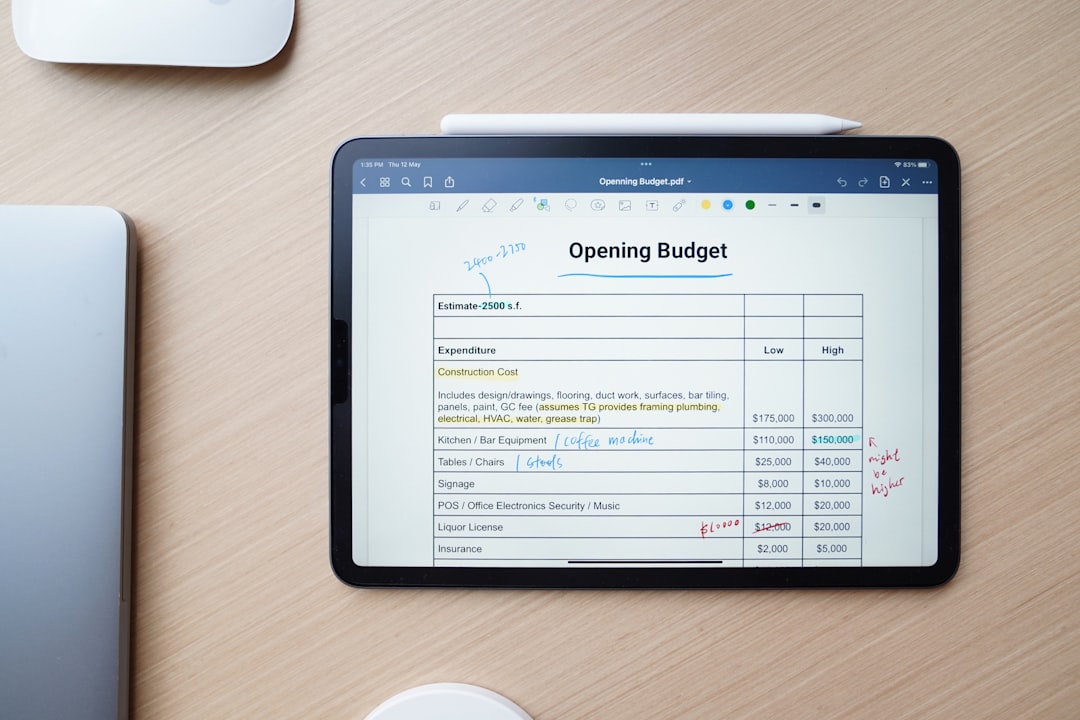

| Category | Metric |

|---|---|

| Income | Total monthly income |

| Expenses | Total monthly expenses |

| Savings | Monthly savings amount |

| Debts | Total outstanding debts |

| Emergency Fund | Amount in emergency fund |

Creating a realistic budget is a cornerstone of effective financial management. A budget serves as a plan for how you will allocate your income towards various expenses and savings goals over a specific period—typically monthly. To create an effective budget, start by listing all sources of income and then categorize your expenses into fixed and variable costs.

Fixed costs are predictable and remain constant each month, while variable costs can fluctuate based on lifestyle choices. This categorization allows for a clearer understanding of where adjustments may be necessary. When developing a budget, it’s important to ensure that it reflects your actual spending habits rather than idealized versions of them.

This means being honest about discretionary spending and accounting for occasional splurges or irregular expenses like car maintenance or medical bills. A common budgeting method is the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. However, this framework should be adjusted based on individual circumstances; for instance, if you’re aggressively paying off debt, you might allocate more than 20% towards that goal.

The key is to create a budget that feels sustainable and aligns with your financial objectives.

Identifying Areas for Cost Cutting

Identifying areas for cost-cutting is an essential step in optimizing your budget and freeing up funds for savings or debt repayment. Start by reviewing your tracked spending data to pinpoint categories where you may be overspending. Common areas ripe for cost-cutting include dining out, entertainment subscriptions, and impulse purchases.

For instance, if you notice that you’re spending a significant amount on takeout meals each month, consider meal prepping at home or exploring budget-friendly recipes that can help reduce food costs. Another effective strategy for cutting costs is to evaluate recurring expenses such as insurance premiums or utility bills. Shopping around for better rates or negotiating with service providers can lead to substantial savings.

Additionally, consider whether certain subscriptions or memberships are truly adding value to your life; if not, canceling them can free up funds for more meaningful pursuits. By taking a proactive approach to identifying unnecessary expenditures, you can create a more efficient budget that aligns with your financial goals.

Building an Emergency Fund

What Should an Emergency Fund Cover?

This fund should cover three to six months’ worth of living expenses and be easily accessible in case of emergencies such as job loss, medical emergencies, or urgent home repairs. Building an emergency fund requires discipline and commitment but can significantly reduce stress during challenging times.

How to Start Building an Emergency Fund

To start building an emergency fund, set a specific savings goal based on your monthly expenses and create a separate savings account dedicated solely to this purpose. Automating transfers from your checking account to this savings account can help ensure consistent contributions without requiring constant attention. Even small contributions can add up over time; for example, setting aside just $50 per month will result in $600 saved in a year.

The Benefits of Having an Emergency Fund

As your emergency fund grows, you’ll gain peace of mind knowing that you’re better prepared for life’s uncertainties.

Sticking to Your Budget

Sticking to your budget requires ongoing commitment and self-discipline but is essential for achieving long-term financial success. One effective strategy is to regularly review your budget against actual spending; this practice helps identify discrepancies and allows for timely adjustments if necessary. If you find yourself consistently overspending in certain categories, it may be time to reassess those allocations or identify triggers that lead to impulsive spending.

Another helpful tactic is to establish accountability measures. Sharing your financial goals with a trusted friend or family member can provide motivation and encouragement as you work towards sticking to your budget. Additionally, consider using budgeting apps that send alerts when you’re nearing spending limits in specific categories; these reminders can serve as helpful nudges to keep you on track.

Ultimately, maintaining focus on your financial goals will help reinforce the importance of adhering to your budget.

Revisiting and Adjusting Your Budget Regularly

Financial circumstances are rarely static; therefore, revisiting and adjusting your budget regularly is vital for ensuring its continued effectiveness. Life events such as job changes, relocations, or changes in family dynamics can significantly impact income and expenses. By conducting regular budget reviews—ideally on a monthly basis—you can assess whether your current budget aligns with your evolving financial situation.

During these reviews, take the time to evaluate both short-term and long-term goals. If you’ve achieved certain milestones—such as paying off debt or reaching a savings target—consider reallocating those funds towards new objectives or increasing contributions towards existing ones. Additionally, if unexpected expenses arise or income fluctuates due to seasonal work or bonuses, adjusting your budget accordingly will help maintain balance and prevent financial strain.

By embracing flexibility in your budgeting process, you’ll be better equipped to navigate the complexities of personal finance while staying aligned with your overarching financial aspirations.

If you are looking for more tips on budget tracking, you should check out this article on Reddit’s best budget tracking tips.

By incorporating these tips into your budget planning, you can achieve greater financial stability and peace of mind.