Budgeting is a fundamental financial practice that involves creating a plan for how to allocate income towards various expenses, savings, and investments. It serves as a roadmap for individuals and families, guiding them in making informed financial decisions. The process of budgeting can seem daunting at first, but it is essential for achieving financial stability and reaching long-term goals.

By understanding where money comes from and where it goes, individuals can gain control over their finances, reduce stress, and work towards a more secure future. At its core, budgeting is about making conscious choices regarding spending and saving. It requires an honest assessment of one’s financial situation, including income sources, fixed and variable expenses, and discretionary spending.

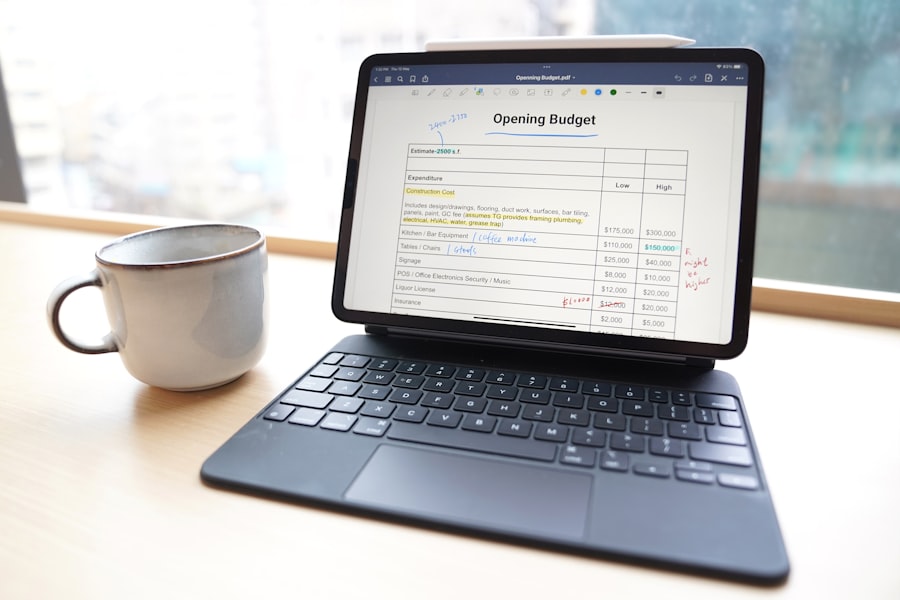

With the rise of technology, budgeting has evolved from traditional pen-and-paper methods to sophisticated budgeting apps that simplify the process. These tools not only help users track their spending but also provide insights into their financial habits, making it easier to identify areas for improvement. As we delve deeper into the world of budgeting, it becomes clear that effective financial management is not just about crunching numbers; it’s about fostering a mindset that prioritizes financial health.

Key Takeaways

- Budgeting is essential for managing your finances and achieving your financial goals.

- Tracking expenses helps you understand where your money is going and identify areas for potential savings.

- When choosing a budget app, look for features such as customizable categories, bill reminders, and the ability to sync with your bank accounts.

- Setting specific, measurable financial goals can help you stay motivated and focused on your budgeting efforts.

- Creating a realistic budget involves accurately estimating your income and expenses, and making adjustments as needed.

The Importance of Tracking Expenses

Identifying Patterns in Spending Behavior

By diligently recording expenses, individuals can identify patterns in their spending behavior, revealing areas where they may be overspending or making impulsive purchases. This awareness is the first step toward making meaningful changes to one’s financial habits. For instance, consider someone who frequently buys coffee from a café on their way to work.

The Power of Awareness

While each cup may seem affordable at the moment, tracking these expenses over a month could reveal that they are spending hundreds of dollars on coffee alone. Recognizing this pattern allows the individual to make informed decisions about whether to cut back on such purchases or find more cost-effective alternatives, such as brewing coffee at home.

Staying Accountable and Proactive

Furthermore, tracking expenses can help individuals stay accountable to their budget, ensuring that they remain aligned with their financial goals. It fosters a sense of discipline and encourages proactive management of one’s finances.

Features to Look for in a Budget App

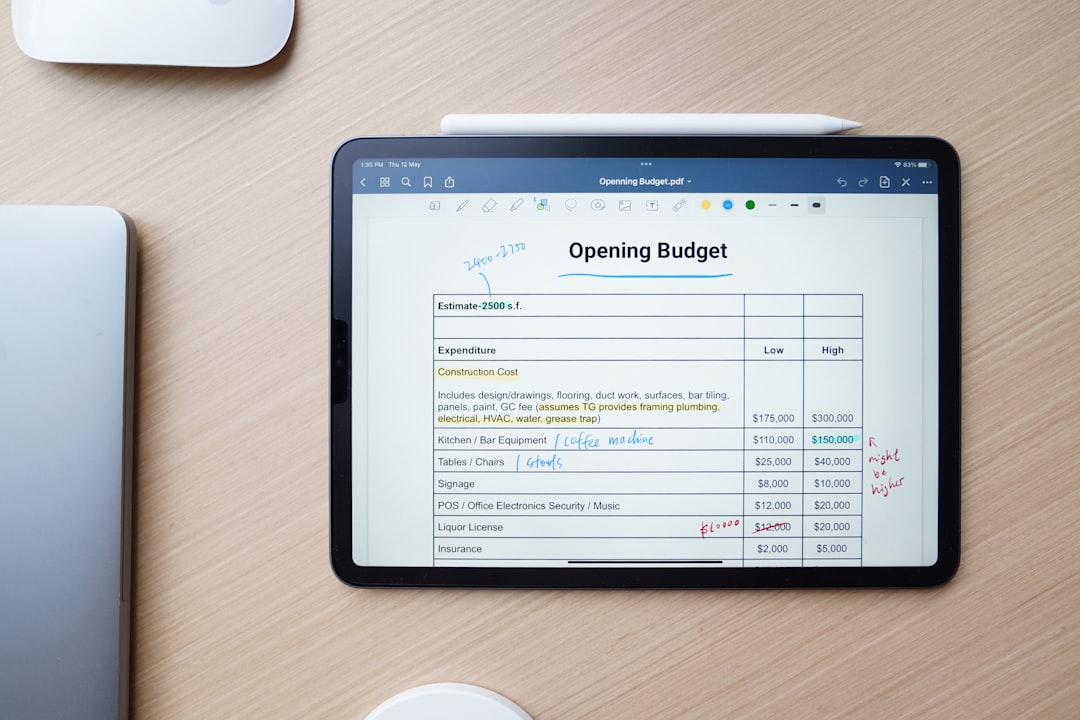

When selecting a budgeting app, it is essential to consider various features that can enhance the user experience and improve financial management. One of the most important features is user-friendliness; an intuitive interface allows users to navigate the app easily without feeling overwhelmed by complex functionalities. A well-designed app should enable users to input their income and expenses quickly while providing clear visualizations of their financial status.

Another critical feature is the ability to sync with bank accounts and credit cards. This functionality automates the tracking process by categorizing transactions in real-time, reducing the need for manual entry. Additionally, look for apps that offer customizable categories for expenses, allowing users to tailor their budget according to their unique spending habits.

Some apps also provide goal-setting features, enabling users to set specific savings targets or debt repayment plans. This can be particularly motivating as it gives users a tangible objective to work towards. Moreover, security is paramount when dealing with sensitive financial information.

A reputable budgeting app should employ robust encryption methods to protect user data from unauthorized access. Some apps also offer features like two-factor authentication for added security. Lastly, consider whether the app provides educational resources or tips on budgeting and financial management.

This can be invaluable for users looking to enhance their financial literacy and make informed decisions.

Setting Financial Goals

| Financial Goals | Metrics |

|---|---|

| Emergency Fund | 3-6 months of living expenses |

| Retirement Savings | Percentage of income saved |

| Debt Repayment | Total amount owed |

| Investment Portfolio | Rate of return |

Setting financial goals is a crucial step in the budgeting process that provides direction and motivation. Goals can vary widely depending on individual circumstances and aspirations; they may include short-term objectives like saving for a vacation or long-term ambitions such as purchasing a home or planning for retirement. By establishing clear goals, individuals can create a budget that aligns with their priorities and helps them stay focused on what truly matters.

To set effective financial goals, it is essential to follow the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of vaguely stating a desire to save money, one might set a specific goal of saving $5,000 for a down payment on a car within two years. This goal is measurable and achievable with proper planning and discipline.

Additionally, it is relevant to the individual’s life circumstances and has a clear timeline attached to it. Once goals are established, they should be integrated into the budgeting process. This means allocating funds each month towards these goals while ensuring that essential expenses are covered.

For instance, if someone aims to save for a vacation in six months, they might decide to set aside a specific amount from each paycheck into a dedicated savings account. This approach not only helps in achieving the goal but also instills a sense of accomplishment as progress is made over time.

Creating a Realistic Budget

Creating a realistic budget requires careful consideration of income sources and expenses while ensuring that it reflects one’s lifestyle and financial goals. The first step in this process is to gather all relevant financial information, including pay stubs, bank statements, and bills. This comprehensive overview allows individuals to understand their total income and fixed expenses—such as rent or mortgage payments—before moving on to variable expenses like groceries and entertainment.

A common mistake when creating a budget is underestimating variable expenses or failing to account for irregular costs such as car maintenance or medical bills. To avoid this pitfall, individuals should review past spending patterns and consider setting aside funds for these occasional expenses within their budget. Additionally, it’s important to build in some flexibility; life is unpredictable, and having a buffer can help accommodate unexpected costs without derailing the entire budget.

Once all income and expenses are accounted for, individuals can allocate funds towards savings and discretionary spending based on their priorities. A popular method for budgeting is the 50/30/20 rule: allocating 50% of income towards needs (essential expenses), 30% towards wants (discretionary spending), and 20% towards savings and debt repayment. However, this rule should be adjusted based on personal circumstances; some may need to allocate more towards savings or debt repayment depending on their financial situation.

Utilizing the App for Expense Tracking

Real-Time Monitoring and Accountability

Once a budget has been established, utilizing a budgeting app for expense tracking can significantly enhance financial management efforts. These apps provide an efficient way to monitor spending in real-time, allowing users to stay accountable to their budgetary goals. By categorizing transactions automatically or manually entering expenses as they occur, individuals can maintain an accurate picture of their financial health throughout the month.

Setting Spending Limits and Receiving Notifications

Many budgeting apps offer features that allow users to set spending limits for different categories based on their budget. For example, if someone has allocated $300 for groceries in a month, the app can send notifications when they approach this limit. This proactive approach helps users make informed decisions about their spending habits and encourages them to adjust their behavior if necessary.

Visual Representations of Spending Patterns

Additionally, some apps provide visual representations of spending patterns through graphs and charts. These visual tools can be incredibly motivating as they highlight progress towards financial goals or reveal areas where adjustments may be needed. For instance, if an individual notices that they consistently overspend in entertainment categories, they can reassess their budget and make necessary changes to align with their overall financial objectives.

Tips for Saving and Investing

Incorporating saving and investing into one’s budget is essential for building wealth over time. One effective strategy is to automate savings by setting up direct deposits into savings accounts or investment accounts as soon as income is received. This “pay yourself first” approach ensures that savings are prioritized before discretionary spending occurs.

Another tip is to take advantage of employer-sponsored retirement plans such as 401(k)s or similar programs that offer matching contributions. Contributing enough to receive the full match is essentially free money that can significantly boost retirement savings over time. Additionally, individuals should consider diversifying their investments across various asset classes—such as stocks, bonds, and real estate—to mitigate risk while maximizing potential returns.

For those looking to save for specific goals—such as buying a home or funding education—consider opening dedicated savings accounts with higher interest rates or investment accounts tailored for long-term growth. High-yield savings accounts or certificates of deposit (CDs) can provide better returns than traditional savings accounts while maintaining liquidity. Moreover, educating oneself about personal finance through books, podcasts, or online courses can empower individuals to make informed investment decisions.

Understanding concepts like compound interest and risk tolerance can lead to more strategic investment choices that align with one’s financial goals.

Reviewing and Adjusting Your Budget

Regularly reviewing and adjusting one’s budget is crucial for maintaining financial health over time. Life circumstances change—such as job changes, unexpected expenses, or shifts in personal priorities—and budgets must adapt accordingly. Setting aside time each month to assess spending patterns against the established budget allows individuals to identify areas where they may be overspending or where adjustments are needed.

During these reviews, it’s beneficial to analyze both successes and challenges faced throughout the month. For instance, if someone successfully saved more than anticipated in one category but overspent in another, they can celebrate their achievements while also strategizing how to improve in areas where they fell short. This reflective practice fosters a growth mindset around budgeting and encourages continuous improvement.

Additionally, if significant life changes occur—such as marriage, having children, or changing jobs—individuals should revisit their budget comprehensively. New responsibilities may require reallocating funds towards different priorities or adjusting savings goals based on changing circumstances. By remaining flexible and open to change within the budgeting process, individuals can ensure that their financial plan remains relevant and effective in helping them achieve their long-term objectives.

In conclusion, effective budgeting encompasses various elements—from tracking expenses and setting goals to utilizing technology for better management practices. By embracing these principles and regularly reviewing one’s financial situation, individuals can cultivate healthier financial habits that lead to greater stability and success over time.

If you are looking for the best budget app, you should check out the article by NYT Wirecutter. They have done extensive research and testing to discover the top budgeting apps available. You can read more about their findings here. Additionally, if you are interested in designing a budget tracker website template on a budget, Valapoint has a helpful article on that topic as well. And if you are looking for a free savings app to help you reach your financial goals, Valapoint also has a great resource for that.

FAQs

What is a budget app?

A budget app is a software application designed to help individuals or businesses manage their finances by tracking income, expenses, and savings goals.

How does a budget app work?

A budget app typically allows users to input their income and expenses, categorize transactions, set budget limits for different spending categories, and track their progress towards financial goals.

What are the benefits of using a budget app?

Using a budget app can help individuals or businesses gain better insight into their financial habits, identify areas for potential savings, and stay on track with their financial goals.

Are budget apps secure?

Most budget apps use encryption and other security measures to protect users’ financial information. It’s important to choose a reputable and trusted budget app to ensure the security of your data.

Are budget apps free to use?

Many budget apps offer free versions with basic features, while others may require a subscription or one-time purchase for access to more advanced features and capabilities.

Can a budget app help with long-term financial planning?

Yes, a budget app can help with long-term financial planning by providing tools to set and track savings goals, monitor investment accounts, and create forecasts for future expenses and income.