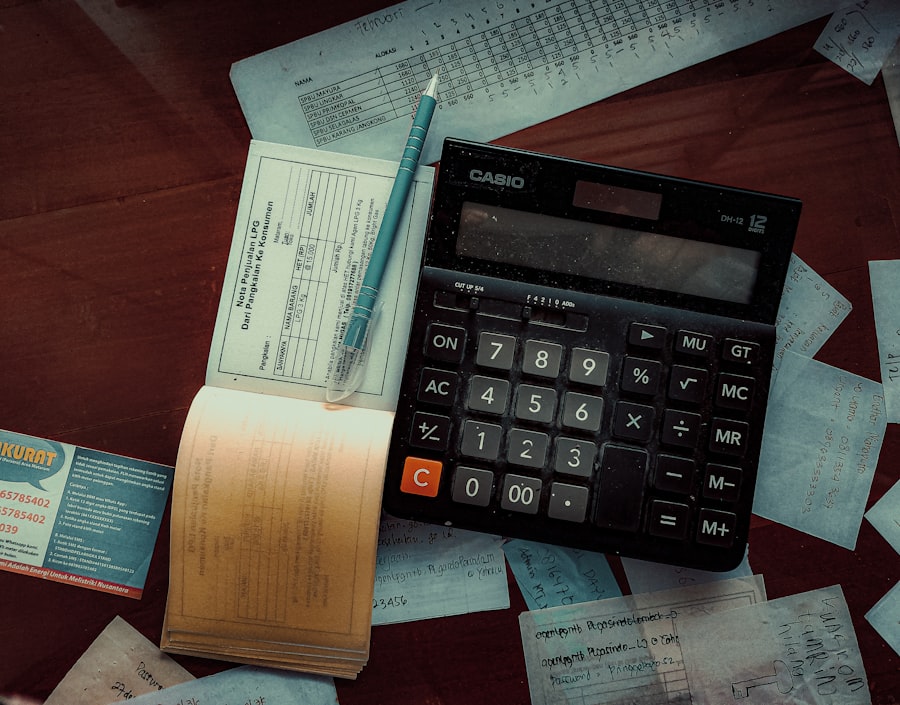

Tracking expenses is a fundamental practice for anyone seeking to gain control over their financial situation. It serves as a mirror reflecting one’s spending habits, revealing where money flows in and out. By meticulously recording every transaction, individuals can identify patterns that may otherwise go unnoticed.

For instance, a person might be surprised to discover that their daily coffee runs accumulate to a significant monthly expenditure. This awareness can prompt a reassessment of priorities and spending behaviors, leading to more informed financial decisions. Moreover, tracking expenses is not merely about recognizing where money is spent; it also plays a crucial role in budgeting and financial planning.

When individuals have a clear picture of their financial landscape, they can allocate resources more effectively. This practice can help in setting realistic savings goals, preparing for unexpected expenses, and ultimately achieving long-term financial stability. In an age where consumerism is rampant and impulse purchases are just a click away, maintaining a disciplined approach to tracking expenses can safeguard against overspending and foster a healthier relationship with money.

Key Takeaways

- Tracking expenses is crucial for understanding where your money is going and making informed financial decisions.

- Choose an expense tracker that aligns with your preferences and needs, whether it’s a mobile app, spreadsheet, or pen and paper.

- Set up your expense tracker by inputting all sources of income and creating categories for different types of expenses.

- Categorize your expenses to easily identify areas where you can cut back and prioritize your spending.

- Analyze your spending habits regularly to identify trends, areas for improvement, and opportunities for saving.

Choosing the Right Expense Tracker for You

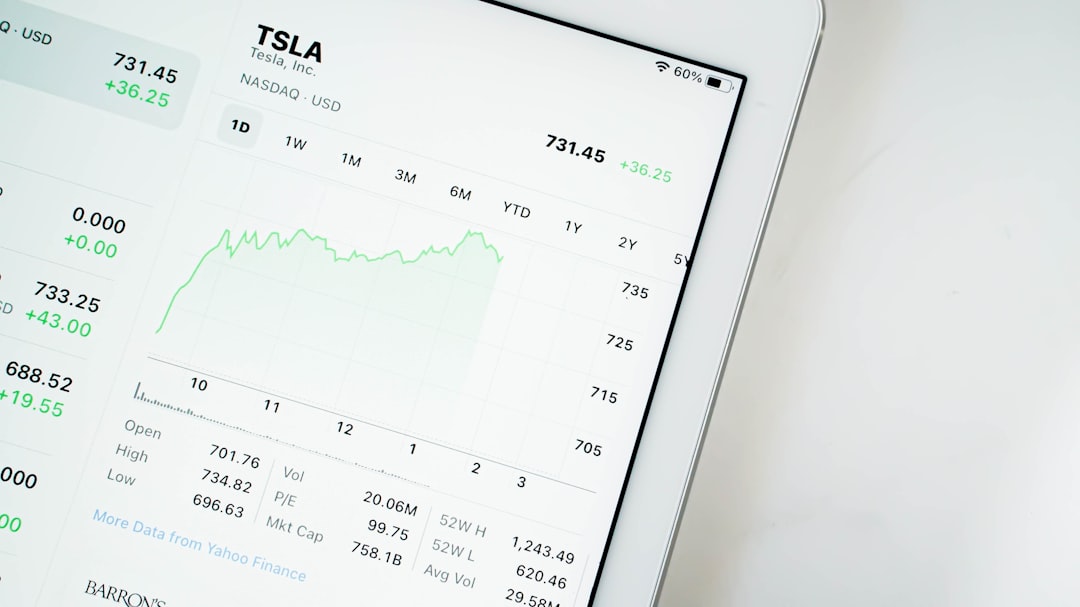

Selecting the appropriate expense tracker is a pivotal step in the journey toward financial management. With a plethora of options available—ranging from mobile applications to traditional spreadsheets—individuals must consider their unique needs and preferences. For tech-savvy users, mobile apps like Mint or YNAB (You Need A Budget) offer user-friendly interfaces and automatic syncing with bank accounts, making it easier to track expenses in real-time.

These applications often come equipped with features such as alerts for overspending and visual representations of spending habits, which can enhance the user experience.

On the other hand, some individuals may prefer a more hands-on approach, opting for spreadsheets or even pen-and-paper methods. This traditional route allows for greater customization and can be particularly appealing to those who enjoy the tactile experience of writing.

Tools like Microsoft Excel or Google Sheets provide flexibility in designing personalized tracking systems, enabling users to create categories that resonate with their specific financial situations. Ultimately, the best expense tracker is one that aligns with an individual’s lifestyle, ensuring that the process remains engaging rather than burdensome.

Setting Up Your Expense Tracker

Once the right expense tracker has been chosen, the next step involves setting it up effectively. This process begins with establishing a clear framework that outlines how expenses will be recorded. For digital trackers, this might mean creating categories such as groceries, transportation, entertainment, and utilities.

Each category should reflect the individual’s spending habits and priorities, allowing for a comprehensive overview of financial activity. For those using spreadsheets, it’s essential to design a layout that is intuitive and easy to navigate, ensuring that data entry becomes a seamless part of daily routines. In addition to categorization, setting up an expense tracker also involves determining the frequency of updates.

Some individuals may find it beneficial to log expenses daily, while others might prefer weekly or monthly reviews. The key is consistency; regular updates help maintain accuracy and provide timely insights into spending patterns. Furthermore, incorporating features such as color coding or graphs can enhance visibility and make it easier to spot trends over time.

By investing time in the initial setup, individuals can create a robust system that simplifies the ongoing task of expense tracking.

Categorizing Your Expenses

| Category |

Percentage of Expenses |

| Housing |

30% |

| Transportation |

15% |

| Food |

20% |

| Utilities |

10% |

| Entertainment |

10% |

| Savings |

15% |

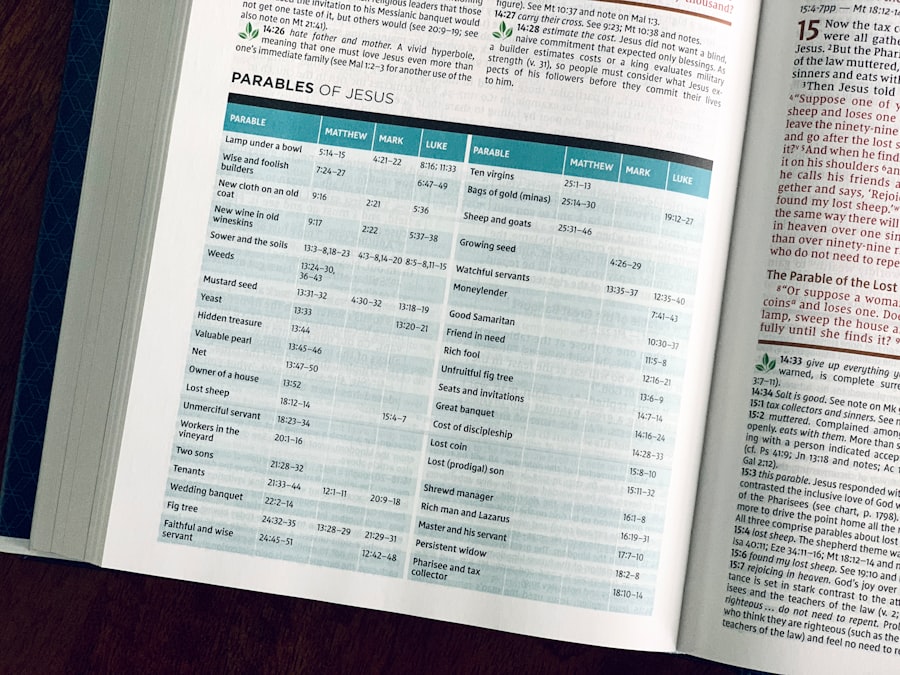

Effective categorization of expenses is crucial for gaining meaningful insights into spending habits. By breaking down expenditures into specific categories, individuals can pinpoint areas where they may be overspending or where adjustments can be made. Common categories include fixed expenses like rent or mortgage payments, variable expenses such as groceries and dining out, and discretionary spending on entertainment or hobbies.

This level of granularity allows for a more nuanced understanding of financial behavior. Moreover, categorization can extend beyond basic groupings to include subcategories that provide even deeper insights. For example, within the dining out category, one might create subcategories for fast food, fine dining, and takeout.

This detailed approach can reveal preferences and tendencies that may not be apparent at first glance. Additionally, some expense trackers allow users to tag transactions with multiple categories or notes, further enhancing the ability to analyze spending patterns. By investing time in thoughtful categorization, individuals can transform their expense tracking into a powerful tool for financial awareness.

Analyzing Your Spending Habits

Once expenses have been tracked and categorized, the next logical step is to analyze spending habits critically. This analysis involves reviewing the data collected over time to identify trends and patterns that may inform future financial decisions. For instance, an individual might notice that they consistently overspend on dining out during certain months or that their grocery bills spike when they shop without a list.

Recognizing these patterns can lead to actionable insights; perhaps it’s time to set stricter limits on discretionary spending or develop a meal planning strategy to reduce grocery costs. Furthermore, analyzing spending habits can also highlight areas where individuals are successfully managing their finances. For example, if someone consistently stays within budget for fixed expenses but struggles with variable costs, this information can guide them in adjusting their budgeting strategies.

Visualization tools within expense trackers—such as pie charts or bar graphs—can make this analysis more accessible and engaging. By regularly reviewing spending habits, individuals can cultivate a proactive approach to their finances rather than merely reacting to financial challenges as they arise.

Creating a Budget Based on Your Expense Tracker

With insights gained from analyzing spending habits, individuals are well-equipped to create a budget that reflects their financial goals and realities. A budget serves as a roadmap for managing income and expenditures, providing structure and accountability in financial decision-making. The first step in this process involves setting clear financial goals—whether saving for a vacation, paying off debt, or building an emergency fund—and aligning the budget accordingly.

When creating a budget based on tracked expenses, it’s essential to differentiate between needs and wants. Fixed expenses should be prioritized first, followed by necessary variable costs like groceries and transportation. Discretionary spending should be allocated last and kept within reasonable limits based on historical spending data.

Additionally, incorporating flexibility into the budget can help accommodate unexpected expenses without derailing overall financial plans. By using insights from expense tracking to inform budgeting decisions, individuals can create realistic and achievable financial plans that promote long-term stability.

Tips for Staying Consistent with Tracking Expenses

Maintaining consistency in tracking expenses can be challenging but is vital for achieving financial goals. One effective strategy is to establish a routine that integrates expense tracking into daily life. For instance, setting aside a specific time each day or week dedicated solely to reviewing transactions can help reinforce this habit.

Whether it’s during morning coffee or before bed, creating a ritual around expense tracking can make it feel less like a chore and more like an essential part of personal finance management. Another helpful tip is to leverage technology to streamline the tracking process. Many expense tracking apps offer features such as automatic transaction imports from bank accounts or credit cards, significantly reducing the manual effort required.

Additionally, setting up alerts for budget limits can serve as reminders to stay on track with spending goals. Engaging with online communities or forums focused on personal finance can also provide motivation and accountability; sharing progress with others can foster a sense of commitment to maintaining consistent tracking practices.

Using Your Expense Tracker to Achieve Financial Goals

An expense tracker is not just a tool for monitoring spending; it can also be instrumental in achieving broader financial goals. By providing clarity on current financial habits and trends, individuals can make informed decisions about how to allocate resources toward their objectives. For example, if someone aims to save for a down payment on a house, they can use insights from their expense tracker to identify areas where they can cut back on discretionary spending and redirect those funds into savings.

Moreover, an expense tracker allows for ongoing adjustments as financial situations evolve. As individuals progress toward their goals—whether through increased income or reduced expenses—they can reassess their budgets and savings strategies accordingly.

Regularly reviewing progress against set goals fosters motivation and reinforces positive financial behaviors.

By viewing an expense tracker as not just a record-keeping tool but as an integral part of the journey toward financial success, individuals can cultivate a proactive mindset that empowers them to take charge of their financial futures effectively.

If you are looking for the best personal finance app to help you track your expenses, you may want to check out this article on the best personal finance app on Reddit. This article provides insights into the top-rated personal finance apps recommended by Reddit users, which can help you manage your finances effectively. Additionally, you may also find this article on Many individuals find themselves overwhelmed by their financial situations, often leading to anxiety and poor decision-making.

By employing a budgeting program, users can visualize their financial landscape, making it easier to understand where their money is going and how they can allocate it more effectively. This clarity fosters a sense of control over one’s finances, empowering users to make informed choices that align with their personal and financial goals. The ability to track progress over time also serves as a motivational tool, encouraging users to stick to their budgets and celebrate milestones along the way.

Key Takeaways

- Budgeting programs are important for managing personal finances and achieving financial goals.

- Features to look for in budgeting programs include expense tracking, goal setting, bill reminders, and customizable budget categories.

- Mint is a popular budgeting program that offers free budget tracking, bill reminders, and credit score monitoring.

- YNAB (You Need a Budget) is a budgeting program focused on giving every dollar a job and helping users break the paycheck-to-paycheck cycle.

- Personal Capital is a budgeting program that offers investment tracking, retirement planning, and net worth monitoring.

Features to Look for in Budgeting Programs

When selecting a budgeting program, several key features should be considered to ensure it meets individual needs effectively. First and foremost, user-friendliness is critical. A program that is intuitive and easy to navigate will encourage consistent use, which is essential for successful budgeting.

Users should look for interfaces that allow for quick data entry and provide clear visualizations of financial information. Features such as drag-and-drop functionality or customizable dashboards can enhance the user experience significantly. Another important feature is the ability to sync with bank accounts and credit cards.

Automatic transaction imports save time and reduce the likelihood of errors that can occur with manual entry. This feature allows users to see real-time updates on their financial status, making it easier to adjust spending habits as needed. Additionally, robust reporting tools are vital; they should provide insights into spending patterns, income sources, and budget adherence over time.

The ability to generate reports can help users identify trends and make informed decisions about future spending and saving.

Mint

Mint is one of the most popular budgeting programs available today, known for its comprehensive features and user-friendly interface. Owned by Intuit, Mint allows users to connect their bank accounts, credit cards, and investment accounts in one place, providing a holistic view of their financial situation. The program automatically categorizes transactions, making it easy for users to see where their money is going each month.

This feature is particularly beneficial for those who struggle with tracking expenses manually, as it eliminates the need for tedious data entry. One of Mint’s standout features is its budgeting tool, which allows users to set specific spending limits for various categories such as groceries, entertainment, and transportation. Users receive alerts when they are nearing their budget limits, helping them stay on track throughout the month.

Additionally, Mint offers personalized insights based on spending habits, suggesting ways to save money or adjust budgets accordingly. The app also includes a goal-setting feature that enables users to set financial objectives, such as saving for a vacation or paying off debt, further enhancing its utility as a comprehensive financial management tool.

YNAB (You Need a Budget)

| Metrics |

Values |

| Active Users |

2 million |

| Monthly Revenue |

12 million |

| Customer Satisfaction |

95% |

| App Downloads |

5 million |

YNAB, or You Need a Budget, takes a unique approach to budgeting that emphasizes proactive financial management rather than reactive tracking. The program is built on four fundamental rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money. This philosophy encourages users to allocate every dollar they earn towards specific expenses or savings goals before they even spend it.

By doing so, YNAB helps users develop a more intentional relationship with their money. One of the most appealing aspects of YNAB is its educational component. The program offers extensive resources, including workshops and tutorials that teach users about budgeting principles and strategies.

This focus on education empowers users to take control of their finances and make informed decisions. Additionally, YNAB’s mobile app allows users to track expenses on the go, ensuring they can stay within budget even when away from home. The ability to adjust budgets in real-time based on changing circumstances further enhances its flexibility and effectiveness as a budgeting tool.

Personal Capital

Personal Capital stands out from traditional budgeting programs by combining budgeting features with investment tracking capabilities. This dual functionality makes it an excellent choice for individuals who want to manage both their day-to-day finances and long-term investment strategies in one platform. Users can link their bank accounts and investment accounts to get a comprehensive view of their net worth and cash flow.

The program provides detailed insights into asset allocation and investment performance, allowing users to make informed decisions about their portfolios. The budgeting aspect of Personal Capital is robust as well; it allows users to set budgets for various categories while tracking spending in real-time. Users can also create savings goals for specific projects or milestones, such as buying a home or funding education expenses.

The program’s retirement planning tools are particularly noteworthy; they offer projections based on current savings rates and expected returns, helping users understand whether they are on track to meet their retirement goals. This combination of budgeting and investment tracking makes Personal Capital an invaluable resource for those looking to take a holistic approach to their financial health.

EveryDollar

EveryDollar is a budgeting app developed by financial expert Dave Ramsey that follows a zero-based budgeting approach. This method requires users to allocate every dollar of their income towards expenses or savings before the month begins, ensuring that no money goes unaccounted for. EveryDollar’s straightforward design makes it easy for users to create monthly budgets quickly and efficiently.

The app allows for customizable categories, enabling users to tailor their budgets according to personal preferences and financial situations. One of the key features of EveryDollar is its simplicity; it does not overwhelm users with unnecessary complexity or features that may not be relevant to their needs. Users can manually enter transactions or connect their bank accounts for automatic updates, providing flexibility in how they manage their finances.

Additionally, EveryDollar offers a premium version that includes advanced features such as bank syncing and detailed reporting tools. This tiered approach allows users to choose the level of functionality that best suits their budgeting style while still benefiting from the core principles of Ramsey’s financial philosophy.

GoodBudget

GoodBudget operates on a digital envelope system that helps users manage their finances by allocating funds into specific categories or “envelopes.” This method has been used traditionally in cash-based budgeting but has been adapted for the digital age through GoodBudget’s app. Users can create envelopes for various spending categories such as groceries, entertainment, and savings goals, allowing them to visualize how much money is available for each area of spending.

The app’s user-friendly interface makes it easy for individuals and families alike to track expenses and stay within budget limits.

GoodBudget also offers features such as syncing across multiple devices, which is particularly useful for households where multiple members are involved in managing finances together. Users can share envelopes with family members or partners, promoting transparency and collaboration in budgeting efforts. Additionally, GoodBudget provides reports that help users analyze spending patterns over time, enabling them to make informed adjustments to their budgets as needed.

PocketGuard

PocketGuard distinguishes itself by focusing on simplifying the budgeting process through its “In My Pocket” feature, which shows users how much disposable income they have after accounting for bills, goals, and necessities. This straightforward approach helps users quickly understand what they can spend without overspending or jeopardizing their financial goals. By linking bank accounts and credit cards, PocketGuard automatically tracks transactions and categorizes them into various spending categories.

The app also includes features that allow users to set savings goals and track progress toward those objectives visually. For instance, if someone wants to save for a vacation or pay off debt, PocketGuard provides insights into how much they need to save each month to reach those goals within a specified timeframe. Additionally, PocketGuard offers alerts when spending approaches budget limits or when bills are due, helping users stay organized and avoid late fees.

This combination of simplicity and functionality makes PocketGuard an appealing choice for those looking for an efficient way to manage their finances without getting bogged down by complex features or overwhelming data entry tasks.

If you are interested in budgeting programs, you may also want to check out Valapoint’s article on money management apps. These apps can help you track your expenses, set financial goals, and stay on top of your budget. With the help of a money management app, you can easily see where your money is going and make adjustments as needed. To learn more about money management apps, visit this link.