EveryDollar is a personal budgeting application developed by Ramsey Solutions. It offers users tools to track income, expenses, and savings, with the aim of facilitating financial control. The application operates on a zero-based budgeting principle, meaning every dollar of income is allocated to a specific category, such as expenses, debt repayment, or savings.

The core premise of EveryDollar is to provide a structured framework for financial planning. Users are encouraged to assign a purpose to all their money, leaving no room for “unaccounted for” funds. This approach aims to foster intentionality in spending and saving.

Core Features and Functionality

EveryDollar’s user interface is designed to be straightforward, allowing individuals to input their financial data and create a budget. The application categorizes spending, enabling users to visualize where their money is going.

Income Tracking

Users can input their income sources and amounts into the application. This serves as the foundation for the zero-based budget, as all subsequent allocations will be drawn from this total. Consistent tracking of income ensures the budget remains aligned with available funds.

Expense Categorization

The application allows for the creation of custom spending categories. Users can then assign specific amounts to each category based on their anticipated spending. This granular approach helps identify spending habits and areas where adjustments might be necessary.

Fixed Expenses

These are recurring costs that generally remain the same each month, such as rent or mortgage payments, loan installments, and insurance premiums. EveryDollar allows users to pre-fill these categories to ensure they are accounted for.

Variable Expenses

These are costs that fluctuate from month to month, like groceries, dining out, entertainment, and utilities. The application provides flexibility in setting estimated amounts and adjusting them as actual spending occurs.

Debt Management

EveryDollar incorporates tools to facilitate debt repayment. Users can list their debts, including interest rates and minimum payments. The application often guides users through different debt snowball or avalanche methods, aiming to accelerate debt reduction.

The Debt Snowball Method

This strategy involves paying off debts in order from smallest balance to largest, regardless of interest rate. The psychological wins of quickly eliminating smaller debts are intended to provide motivation.

The Debt Avalanche Method

This method prioritizes paying off debts with the highest interest rates first. While it may take longer to show initial progress, it typically results in less interest paid over the life of the debts.

Savings Goals

The application enables users to set specific savings targets, such as for an emergency fund, a down payment on a house, or retirement. By allocating funds to these goals within the budget, users are actively working towards their long-term financial aspirations.

Budgeting Philosophies Supported

EveryDollar is built upon the principles advocated by financial expert Dave Ramsey. His teachings emphasize a disciplined approach to managing money, often characterized by a focus on eliminating debt and building wealth through consistent saving and investing.

The Zero-Based Budgeting Principle

As mentioned, this is the cornerstone of EveryDollar. The philosophy dictates that for every unit of currency earned, a corresponding unit must be assigned a destination. Income – Expenses – Savings – Debt Repayment = 0. This leaves no room for impulsive or unplanned spending to go unnoticed. It’s akin to a ship captain meticulously charting every ounce of fuel for a long voyage, ensuring no drop is wasted or unaccounted for.

Financial Stewardship

The application promotes a mindset of responsible financial management. It encourages users to view their money not as something to be spent freely, but as a resource to be stewarded wisely towards defined objectives. This perspective shifts the focus from immediate gratification to long-term financial well-being.

Behavioral Finance Integration

While not explicitly termed as such, EveryDollar’s design subtly incorporates principles of behavioral finance. The visual representation of spending, the clear allocation of funds, and the progress tracking on debt and savings can influence user behavior by making financial actions more tangible and their consequences more apparent. The act of consciously assigning every dollar can be a powerful psychological anchor, guiding choices away from impulsive buys and towards planned allocations.

User Experience and Accessibility

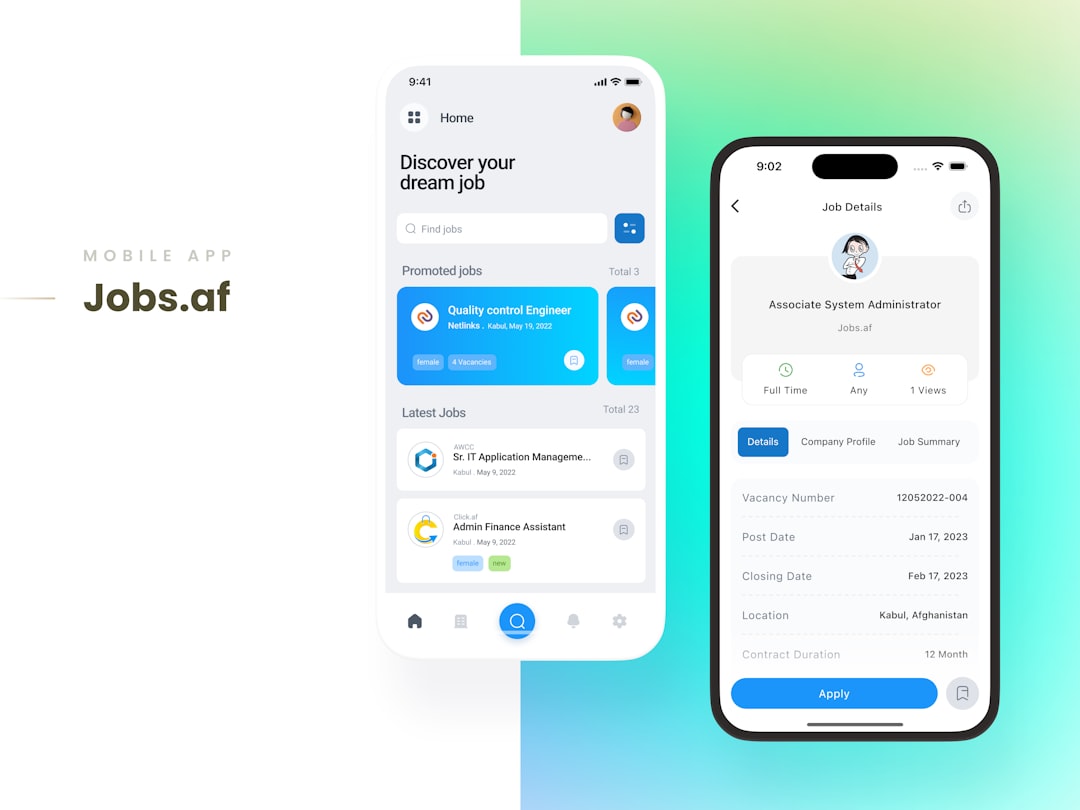

The design of EveryDollar aims for simplicity and ease of use. The platform is available through web browsers and as a mobile application, allowing for access across different devices.

Web Platform

The desktop version of EveryDollar offers a comprehensive interface for budget creation and management. Users can access all features from their computer, providing a larger screen for detailed review and data entry.

Mobile Application

The EveryDollar mobile app allows users to manage their finances on the go. This is particularly useful for real-time expense tracking, enabling users to log purchases immediately and maintain the accuracy of their budget. The convenience of a mobile app means that the budget isn’t confined to a desk; it can be a constant companion, allowing for adjustments and checks throughout the day.

Free vs. Paid Versions

EveryDollar offers a free version with core budgeting functionalities. A premium subscription, known as EveryDollar Plus, provides access to additional features, such as automatic bank syncing and access to Ramsey’s financial coaching resources. The free version provides a solid entry point for those new to budgeting, while the paid version offers enhanced convenience and support for those seeking a more automated and guided experience.

Benefits of Using EveryDollar

The consistent application of EveryDollar’s principles can lead to several positive financial outcomes. By providing a clear roadmap, the application aims to empower individuals to take control of their financial lives.

Increased Financial Awareness

One of the primary benefits is the heightened awareness of spending habits. By detailing every expense, users gain a clear picture of where their money is being directed. This visibility can be the first step towards making informed decisions and identifying areas for potential reduction. It’s like turning on a bright light in a dimly lit room, revealing hidden patterns and possibilities.

Debt Reduction Acceleration

The structured approach to debt management within EveryDollar can significantly speed up the process of becoming debt-free. By prioritizing repayment strategies and tracking progress, users are motivated to tackle their debts with a clear plan. This systematic approach can transform the daunting task of debt repayment into a manageable and achievable goal.

Improved Savings Habits

The ability to set and track savings goals encourages a more disciplined approach to saving. By allocating specific amounts to savings within the budget, users are more likely to reach their financial objectives, whether for short-term needs or long-term investments. This consistent saving builds a financial cushion or a platform for future growth.

Reduced Financial Stress

Financial uncertainty is a major source of stress for many individuals. By providing a clear plan and visibility into their finances, EveryDollar can help alleviate this anxiety. Knowing where your money is going and having a plan for the future can foster a sense of control and peace of mind. This reduction in financial stress can have a ripple effect, positively impacting other areas of life.

Potential Criticisms and Considerations

While EveryDollar offers a robust budgeting framework, there are aspects that may not suit every individual’s financial situation or preferences.

Rigidity of Zero-Based Budgeting

For some, the strict nature of zero-based budgeting can feel restrictive. Life is often unpredictable, and unexpected expenses can arise, requiring deviations from a meticulously planned budget. While EveryDollar allows for budget adjustments, the constant need to reallocate funds in a zero-based system might be a source of friction for those who prefer a more fluid approach. Think of it as trying to fit a square peg into a round hole; sometimes, the system’s inherent structure might not perfectly align with every individual’s unique financial landscape.

Learning Curve for Advanced Features

While the basic budgeting functions are generally accessible, some users might find the more advanced features, particularly in the EveryDollar Plus version, to require a period of adjustment. Understanding how to best utilize automatic syncing or integrate complex financial data might necessitate a learning investment. The initial onboarding and mastery of all functionalities can sometimes feel like navigating a new city without a map; you might get there, but it could be a bit disorienting at first.

Reliance on Manual Entry (Free Version)

The free version of EveryDollar relies heavily on manual input of financial data. This can be time-consuming and prone to human error or oversight. Forgetting to log an expense or miscategorizing a transaction can lead to inaccuracies in the budget. This manual approach means the budget is only as accurate as the diligence of the user; it requires a consistent and dedicated habit of data entry.

Dave Ramsey’s Philosophy May Not Align with All Financial Strategies

Dave Ramsey’s teachings, and thus EveryDollar’s underlying philosophy, are heavily focused on aggressive debt payoff and a generally conservative investment approach. Individuals with different financial philosophies, such as those who prioritize investing over aggressive debt reduction in all circumstances, might find the application’s built-in strategies limiting. The ‘one-size-fits-all’ approach to financial advice, while effective for many, may not resonate with everyone’s personal economic context or risk tolerance.

Cost of EveryDollar Plus

While the free version is functional, unlocking the full potential of EveryDollar, including automatic bank syncing, requires a paid subscription for EveryDollar Plus. For individuals on very tight budgets, the additional cost might be a barrier. The decision to subscribe depends on the perceived value of the added convenience and features versus the monthly expense. It becomes a calculation of return on investment for financial management tools.

EveryDollar presents itself as a practical tool for individuals seeking to impose order and intention upon their financial lives. By adhering to a structured budgeting method and providing visual aids for tracking income and expenses, the application aims to empower users to make more informed financial decisions. Its accessibility through both web and mobile platforms ensures that financial management can be conducted at the user’s convenience. Whether one chooses the free or premium version, the underlying principle remains consistent: to foster proactive control over one’s financial future.